New Initiatives, Sales Growth to Drive Shares to New Highs

![]() Download Report in PDF Or Scroll down to read the complete report below.

Download Report in PDF Or Scroll down to read the complete report below.

CLEANGO INNOVATIONS, INC.

New Initiatives, Sales Growth to Drive Shares to New Highs

Rob Goldman

August 04, 2025

CLEANGO INNOVATIONS INC. (OTCQB: CLGOF – $0.38; CSE: CGII – $0.80)

Industry: Clean Energy

6 Mo. Price Target: $2.00

COMPANY SNAPSHOT

CleanGo Innovations Inc. is at the forefront of developing and commercializing proprietary non-toxic, biodegradable cleaning and industrial solutions for oil services and industrial cleaning markets. Driven by a mission for environmental sustainability, CleanGo’s innovative product suite is designed to deliver high performance while safeguarding the planet, serving critical cleaning needs across the oil and gas, mining, commercial, and retail sectors globally.

KEY STATISTICS

- Price as of Price as of 8/1/25

$0.38 - 52 Wk High – Low

$0.6846 – $0.12 - Est. Shares Outstanding

7.1M - Market Capitalization

$2.7M - Average Volume

198 - Exchange:

OTCQB

COMPANY INFORMATION

CleanGo Innovations, Inc.

9595 Six Pines Drive

Suite 8210

The Woodlands TX 77380

Web: www.CleanGoInnovations.com

Email: info@cleangoinnovations.com

Phone : 346.202.6202

INVESTMENT HIGHLIGHTS

In our view, CleanGo is poised to change the way oil and gas industry, along with the overall commercial sector, approaches critical industrial cleaning applications. CleanGo has a non-toxic, Green Seal Certified, easily applied spray that is cost-effective and offers a major, hidden ROI.

The size of the potential markets just in the oil and gas space are projected to grow from $33.42B today to $50.24 by 2034. These include cleaning wells, tanks, tankers, and other vessels and equipment around the world.

Management estimates that there are an estimated 2 million wells globally, with approximately 400,000 of them, or one in five, clogged or stagnant. CleanGo’s green solutions are vital for restoring these wells to optimal production and enhancing oil recovery.

We believe sales could jump from $940K in 2025 to $10M in 2027. Plus, with strong gross margin and low SG&A costs, CleanGo could be operating profitably with just $4M in annual sales.

In our view, these shares are underfollowed and grossly undervalued. Our 6-month price target of $2.50 reflects a low 3.5x price/sales multiple on projected 2026E sales, a metric similar to that of the Russell Microcap Growth Index. Given the expected sales growth rate, and path to profit, our price target and metric could be considered conservative. Looking ahead, future milestones could eventually lead to an M&A event.

COMPANY OVERVIEW

The View from 30,000 Feet

Emerging clean solutions developer CleanGo Innovations, Inc. (OTC-CLGOF; CSE-CGII) appears poised to enjoy substantial sales growth. The Company has created a novel, non-toxic, biodegradable, cutting-edge suite of green-certified, easy “spray-on” cleaning products with industrial applications. CleanGo products are poised to be utilized by customers across the globe in the oil and gas industry as a complement to the Company’s historical commercial and retail customers. To date, the commercial space is largely represented by the hotel industry, which serve as top-tier referenceable users. In our view, the Company is especially well-positioned to solve the current cleaning challenges in core segments of the oil and gas ecosystem. These include proper and required cleaning (or clean-outs) of tanks, tankers and other vessels and equipment.

Typical, legacy cleaning methods are problematic for the industrial and commercial sectors. Legacy cleaning methods often rely on harsh chemicals that pose risks to human health and the environment. Moreover, the mixed or limited cleaning efficacy of these products can lead to operational inefficiency for customers. The non-toxic, easy-to-use CleanGo suite of products address these issues and offer potential outperformance at a cost-effective price.

Huge Market Opportunities

According to Grandview Research, the industrial and institutional cleaning chemicals market on a global basis is projected to grow from $80.05 billion in 2024 to $167.17 billion by 2033. Separately, a sub-segment of this market, the global oilfield chemicals market, low-hanging fruit that represents a key segment of the broader oil patch chemicals market, is projected to grow from $33.42 billion in 2025 to $50.24 billion in 2034. These forecasts by Precedence Research also note that in 2024, the Middle East and Africa markets accounted for $12.68 billion or around 40% of the market in 2024. Thus, CleanGo has a huge marketing opportunity in this segment alone.

Interestingly, a large market opportunity that represents low-hanging fruit for the Company is the critical issue of clogged and stagnant wells. Management estimates that there are an estimated 2 million wells globally, with approximately 400,000 of them, or one in five, clogged or stagnant. CleanGo’s solutions are vital for restoring these wells to optimal production while simultaneously enhancing oil recovery. Such after-effects would serve as boon to oil producers and oil service companies, thereby increasing their ROI and production capabilities.

On the heels of this opportunity, we believe that as sales and implementation of the Company’s products reach critical mass, CleanGo could serve as a replacement for this segment’s existing methods and solutions, due to the aforementioned inherent advantages. CleanGo’s positioning as an innovative green cleaning solutions provider could provide a competitive advantage as the oil and gas industry increasingly emphasizes environmental sustainability.

The CleanGo Difference

CleanGo’s flagship proprietary product, CG-100, offers a groundbreaking solution through its innovative technology, which utilizes a green emulsification process that is safer, environmentally responsible, and cost-effective. CleanGo Innovations Inc. uses only the greenest products blended to create what may be the industry’s most effective non-toxic and non-caustic cleaner available. Backed by revolutionary breakthroughs in cleaning science, CleanGo’s Green Seal Certified solutions work at a molecular level to penetrate deeply for a 100% molecular level clean.

Plus, its ease-of-use is likely unmatched. All it requires is to spray it on or in the target area. A hidden benefit of using CG-100, particularly in the industrial sector, is the underlying, substantial cost savings in cleanup efforts while ensuring worker safety. Thus, an enviable ROI can be generated by CleanGo customers and users. In addition, as an ESG (Environmental, Social, and Governance) selling feature, CleanGo’s proprietary formulation is one of a very few that is Green Seal Registered. It is also DIN-certified, and it has disinfectant properties.

Looking Ahead

Historical sales have been primarily to the commercial and retail segments through third parties and direct sales. However, a renewed focus on the oil and gas and other related industrial sectors are just beginning to bear fruit and will likely dominate company sales in 2026 and beyond. We believe that management is engaged in a series of initiatives to address opportunities in oil well and tank cleaning whereby CleanGo emerges as the go-to provider for this industry segment.

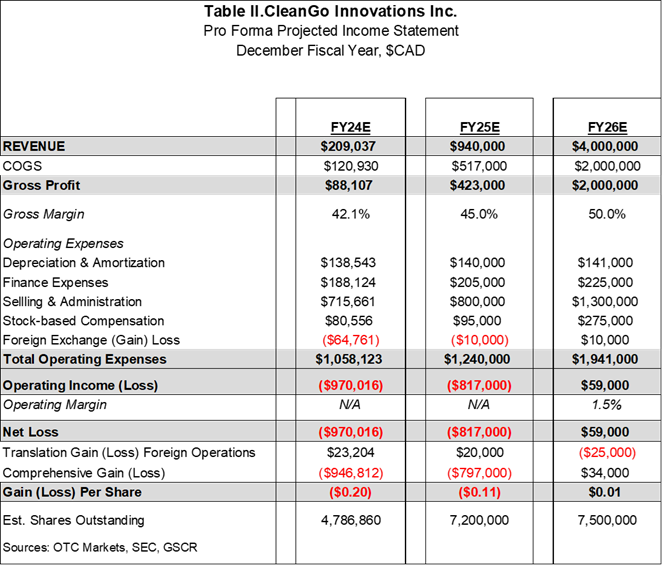

We believe that sales could achieve $940,000 (CAD) in 2025, as the Company introduces its products to multiple markets, and could generate $4M (CAD) in revenue in 2026. On a preliminary basis, our assumptions project that CleanGo could potentially surpass the $10M mark in 2027. As we approach the end of the September quarter, we will have more clarity on the magnitude of future sales and deployment. Thus, we anticipate publishing a detailed projected P&L for the Company. With a likely rise in current gross margin to the forecasted 50% level once critical mass production is achieved, we believe that CleanGo can achieve quarterly operating profit once it reaches a $4M annual revenue run-rate.

CleanGo’s shares are underfollowed and grossly undervalued. Moreover, we believe that the Company could emerge as an M&A candidate as it becomes a replacement for the installed base of cleaning products.

Our 6-month price target of $2.00 reflects a reasonable 3.5x price/sales multiple on our 2026 sales forecast of $4M. It should be noted that the Russell Microcap Growth Index 12-month forward price/sales ratio is between 3.5x-4x. Given the expected sales growth rate for CleanGo, and the product’s competitive advantages, we believe that this price/sales multiple we presently assign to the Company’s shares could prove to be conservative.

THE CLEANGO INNOVATIONS TEAM

Anthony Sarvucci, Chief Executive Officer

Mr. Sarvucci is the founder and president of CleanGo GreenGo. He has a record as a proven executive and innovative founder in both the private and public sectors and been involved with numerous mergers, acquisitions and public listings in the finance, oil and gas, and consumer packaged goods sectors.

Paula Sarvucci, Chief Financial Officer, Treasurer

Ms. Sarvucci is a director of Clean Go Green Go and an Officer of CleanGo Innovations. She is an employee of CleanGo Innovations as well as the acting CFO. Paula has prior US public company experience and currently acts as the company’s CFO.

Dr. Darren Clark, BSc, PhD, Director

Dr. Clark has over 15 years of experience in health, nutrition and psychiatric research. Holding a PhD in Neuroscience from the University of Alberta, Darren has authored over 25 peer reviewed articles and numerous international awards for her work in alternative therapeutics

Morgan Rebrinsky, PEng, MBA, Director

Mr. Rebrinsky is a professional engineer who specializes in operations, logistics and business strategy. He has extensive project management experience and has been assisting Clean Go Green Go with alpha and beta testing and operations management. He is currently director of asset and liability management with an engineering consulting firm.

FINANCIALS

There is a lot to like about the CleanGo financial and corporate structure. Management runs a tight ship at CleanGo, given the broad array of vertical markets and products. The Company’s quarterly SG&A expenses are below that of companies of comparable size. We should also note that CleanGo has a solid balance sheet, with no long-term debt and very manageable short-term debt as well. Finally, with fewer than 3 million shares in the public float, these shares have the ability to trade in an orderly fashion.

We believe that sales could achieve $940,000 in 2025, and as the Company introduces its products to multiple new, large-volume markets, it could generate $4M in revenue in 2026 and surpass the $10M mark in 2027. As we approach the end of the September quarter, we will have more clarity on the magnitude of future sales and deployment, along with average sales sizes and re-order frequency in the oil and gas market. Thus, we anticipate publishing a detailed projected P&L for the Company. With a 2026 projected gross margin of around 50%, we believe that CleanGo can achieve quarterly operating profit once it reaches a $4M annual revenue run-rate.

While we believe that these shares will trade based on a price/sales multiple for the next 2-3 years due to its high projected growth rate, we further surmise that CleanGo’s low-cost structure could result in higher-than-average EBITDA or adjusted EBITDA growth rates. This metric is key in the Company’s core vertical markets and peer group.

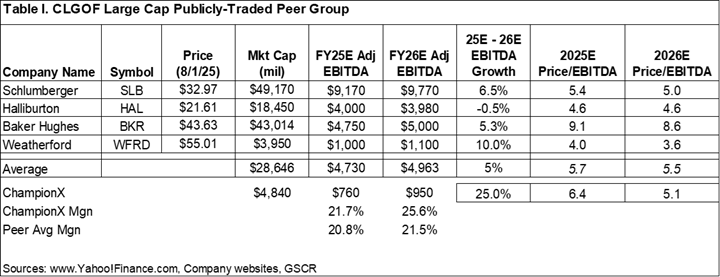

The major players in the oil and gas services space are valued on a price/adjusted EBITDA basis, as illustrated in Table I. It should be noted that ChampionX was acquired in July 2025 for roughly $4.8 billion, at closing. The price/adjusted EBITDA multiple for the acquisition was meaningfully higher than the peer group due to its higher-than-average adjusted EBITDA margin and higher growth rate, in general. By the way, when the all-stock deal was originally announced in early 2025, the acquirer, Schlumberger (NYSE: SLB) was trading much higher. Thus, the original projected multiple was roughly 10x 2025 adjusted EBITDA.

This original metric is instructive for CleanGo as we believe that this valuation metric could be representative of a future valuation in an M&A event for CleanGo, given its projected path. As a result, investors can surmise that if management is able to hit financial targets, the current share price is incredibly undervalued.

RISK FACTORS

In our view, the Company’s primary near-term risks are new market penetration delays and achieving operating profit status. On a secondary basis, selling products to multiple market categories can be challenging to young companies as personnel can be spread thin. Still, this is a problem that as an early-stage company experiences growth, one would be happy to have. Finally, competitive risks could include the introduction of new products with similar characteristics, pricing and efficacy in their target markets. These firms could be existing or new players of varying sizes. However, these competitive risks are typical for companies of CleanGo’s size. Given the inherent advantages of innovative, broadly certified green technology and its growing installed base, we do not believe that this will be a major factor going forward. This model is simply replacing an unappealing and ineffective method with a more effective, clean method that can prove to be cost-effective at purchase and from an ROI perspective.

Volatility and liquidity are typical concerns for microcap stocks that trade on the over the counter (OTC) stock market. It is also possible that the share count could increase to fund future business or product development, or new marketing campaigns. However, an overriding financial benefit as a public company is the favorable access to and the availability of capital to fund development that leads to future sales growth, along with other key initiatives. Since the proceeds of any future funding would be used, in large part, to advance major business development, we believe that any dilutive effect from such a funding could be offset by related increases in market value.

CONCLUSION

In our view, CleanGo is poised to change the way oil and gas industry, along with the overall commercial sector, approaches critical industrial cleaning applications. The Company has a non-toxic, green-certified, easily applied spray that is cost-effective and offers a major, hidden ROI. The size of the potential markets just in the oil and gas space are projected to grow from $33.42B today to $50.24 by 2034. These include cleaning wells, tanks, tankers, and other vessels and equipment around the world. Management estimates that there are an estimated 2 million wells globally, with approximately 400,000 of them, or one in five, clogged or stagnant. CleanGo’s green solutions are vital for restoring these wells to optimal production and enhancing oil recovery.

We believe sales could jump from $940K in 2025 to $10M in 2027. Plus, with strong gross margin and low SG&A costs, CleanGo could be operating profitably with just $4M in annual sales. In our view, these shares are underfollowed and grossly undervalued. Our 6-month price target of $2.50 reflects a low 3.5x price/sales multiple on projected 2026E sales, a metric similar to that of the Russell Microcap Growth Index. Given the expected sales growth rate, and path to profit, our price target and metric could be considered conservative. Looking aead, future milestones could eventually lead to an M&A event.

SENIOR ANALYST: ROBERT GOLDMAN

Rob Goldman founded Goldman Small Cap Research in 2009 and has over 20 years of investment and company research experience as a senior research analyst and as a portfolio and mutual fund manager. During his tenure as a sell side analyst, Rob was a senior member of Piper Jaffray’s Technology and Communications teams. Prior to joining Piper, Rob led Josephthal & Co.’s Washington-based Emerging Growth Research Group. In addition to his sell-side experience Rob served as Chief Investment Officer of a boutique investment management firm and Blue and White Investment Management, where he managed Small Cap Growth portfolios and The Blue and White Fund.

Analyst Certification

I, Robert Goldman, hereby certify that the view expressed in this research report accurately reflect my personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the recommendations or views expressed in this research report.

Disclaimer

This Opportunity Research report was prepared for informational purposes only.

Goldman Small Cap Research, (a division of Two Triangle Consulting Group, LLC) produces research via two formats: Goldman Select Research and Goldman Opportunity Research. The Select format reflects the Firm’s internally generated stock ideas along with economic and stock market outlooks. Opportunity Research reports, updates and Microcap Hot Topics articles reflect sponsored (paid) research but can also include non-sponsored micro-cap research ideas that typically carry greater risks than those stocks covered in the Select Research category. It is important to note that while we may track performance separately, we utilize many of the same coverage criteria in determining coverage of all stocks in both research formats. Research reports on profiled stocks in the Opportunity Research format typically have a higher risk profile and may offer greater upside. Goldman Small Cap Research was compensated by the Company in the amount of $3000 for a research report and press release. All information contained in this report was provided by the Company via filings, press releases or its website, or through our own due diligence. Our analysts are responsible only to the public, and are paid in advance to eliminate pecuniary interests, retain editorial control, and ensure independence. Analysts are compensated on a per report basis and not on the basis of his/her recommendations.

Goldman Small Cap Research is not affiliated in any way with Goldman Sachs & Co.

Separate from the factual content of our articles about the Company, we may from time to time include our own opinions about the Company, its business, markets and opportunities. Any opinions we may offer about the Company are solely our own and are made in reliance upon our rights under the First Amendment to the U.S. Constitution and are provided solely for the general opinionated discussion of our readers. Our opinions should not be considered to be complete, precise, accurate, or current investment advice. Such information and the opinions expressed are subject to change without notice.

The information used and statements of fact made have been obtained from sources considered reliable but we neither guarantee nor represent the completeness or accuracy. Goldman Small Cap Research did not make an independent investigation or inquiry as to the accuracy of any information provided by the Company, or other firms. Goldman Small Cap Research relied solely upon information provided by the Company through its filings, press releases, presentations, and through its own internal due diligence for accuracy and completeness. Such information and the opinions expressed are subject to change without notice. A Goldman Small Cap Research report or note is not intended as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed. This report does not take into account the investment objectives, financial situation, or particular needs of any particular person. This report does not provide all information material to an investor’s decision about whether or not to make any investment. Any discussion of risks in this presentation is not a disclosure of all risks or a complete discussion of the risks mentioned. Neither Goldman Small Cap Research, nor its parent, is registered as a securities broker-dealer or an investment adviser with FINRA, the U.S. Securities and Exchange Commission or with any state securities regulatory authority.

ALL INFORMATION IN THIS REPORT IS PROVIDED “AS IS” WITHOUT WARRANTIES, EXPRESSED OR IMPLIED, OR REPRESENTATIONS OF ANY KIND. TO THE FULLEST EXTENT PERMISSIBLE UNDER APPLICABLE LAW, TWO TRIANGLE CONSULTING GROUP, LLC WILL NOT BE LIABLE FOR THE QUALITY, ACCURACY, COMPLETENESS, RELIABILITY OR TIMELINESS OF THIS INFORMATION, OR FOR ANY DIRECT, INDIRECT, CONSEQUENTIAL, INCIDENTAL, SPECIAL OR PUNITIVE DAMAGES THAT MAY ARISE OUT OF THE USE OF THIS INFORMATION BY YOU OR ANYONE ELSE (INCLUDING, BUT NOT LIMITED TO, LOST PROFITS, LOSS OF OPPORTUNITIES, TRADING LOSSES, AND DAMAGES THAT MAY RESULT FROM ANY INACCURACY OR INCOMPLETENESS OF THIS INFORMATION). TO THE FULLEST EXTENT PERMITTED BY LAW, TWO TRIANGLE CONSULTING GROUP, LLC WILL NOT BE LIABLE TO YOU OR ANYONE ELSE UNDER ANY TORT, CONTRACT, NEGLIGENCE, STRICT LIABILITY, PRODUCTS LIABILITY, OR OTHER THEORY WITH RESPECT TO THIS PRESENTATION OF INFORMATION.