Investment and Company Research

Opportunity Research

COMPANY REPORT

July 08, 2025

ACADIA ENERGY CORPORATION

(OTC – AECX)

Industry: Clean Energy

6-12 Mo. Price Target: $0.15

ACADIA ENERGY CORPORATION (OTC – AECX – $0.023)

Industry: Clean Energy Integration

6 Mo. Price Target: $0.15

COMPANY SNAPSHOT

Acadia Energy Corporation seeks to enhance the sustainability and modernization of the nation’s energy infrastructure via a highly focused integration approach. The Company’s strategy leads to lower power costs for municipalities and communities which foster economic growth, job creation and improved quality of life. Acadia Energy is currently targeting Upstate New York, and its strategy is replicable in municipalities across the U.S. The Company is also actively engaged in a series of high growth, mission critical clean energy projects.

KEY STATISTICS

- Price as of 7/7/25

$0.023

- 52 Wk High – Low

$0.61 – $0.0061

- Est. Shares Outstanding

415M

- Market Capitalization

$9.5M

- Average Volume

17,934

- Exchange:

OTCPK

COMPANY INFORMATION

ACADIA ENERGY CORPORATION

5455 West Lake Road

Auburn NY 13021

Web: www.AcadiaEnergy.com

Email: jbay@acadiaenergy.com

Phone : 315.646.6000

INVESTMENT HIGHLIGHTS

Clean energy integrator Acadia Energy’s share price is poised for a re-valuation as it evolves from a pre-revenue firm to a meaningful revenue generator. We believe that the Company could achieve $3.8M in revenue by year-end 2025.

The Company is uniquely positioned to emerge as a major player in energy systems integration in upstate New York. Current opportunities represent billions of dollars in project revenue.

Acadia Energy benefits from key New York state mandates. For example, a significant majority of electricity must come from clean sources.

Acadia Energy owns key competitive advantages over its peers. The leadership team has spent nearly a decade fostering a true public-private partnership with counties and towns in upstate New York. Plus, management has decades of experience in large scale integration projects.

In our view, the Acadia Energy approach is a replicable model for other projects in the US. In addition, the Company is exploring other clean energy opportunities, potentially diversifying the revenue base.

Our 6–12-month price target of $0.15 represents a 5.0 price/revenue multiple on 2026 forecasted revenue of $12M, a more than 200% leap from our $3.8M forecast for 2025. These shares were above our target price a few months ago, thus we believe upside exists.

COMPANY OVERVIEW

The View from 30,000 Feet

In our view, New York-based Acadia Energy Corporation (OTC: AECX) is uniquely positioned to emerge as a leading and enviable player in large-scale, and innovative diverse energy integration projects in the U.S. Importantly, the Company’s approach should begin to bear fruit later this year, taking Acadia Energy from a pre-revenue firm to a revenue-generating company, thereby providing a major boost in its valuation and share price. We preliminarily forecast that Acadia Energy could record $3.8M in pre-development and operating revenue in 2025 and $12M in revenue in 2026, with a 5-10% operating margin.

Specifically, this energy systems integrator is primed to lead and operate large-scale microgrid networks for communities in upstate New York, a multi-billion-dollar opportunity in the coming years. Acadia Energy benefits from state mandates that call for a significant reduction in greenhouse gases and specific electricity mandates regarding energy generation sources.

These mandates state that New York must achieve a 40% reduction in greenhouse gas emissions by 2030 and an 85% reduction by 2050, using 1990 as the baseline year. The remaining 15% of emissions may be offset through approved methods such as carbon capture, reforestation, or other negative emissions technologies—leading to net-zero emissions economy-wide by 2050. In the electricity sector, the law requires that 70% of electricity come from clean sources by 2030, and that the grid be entirely zero-emissions by 2040. The law also requires that at least 35% (ideally 40%) of the benefits of state climate investments be directed toward disadvantaged communities. These communities are often disproportionately affected by pollution and economic inequality. While these targets may be adjusted due to delays, funding questions, etc., the opportunity remains huge.

Acadia Energy’s Core Advantages

For nearly a decade, the Company and its leadership have established a true public-private partnership with key counties and towns in upstate New York. As the counties move forward and come online, Acadia Energy is well positioned to lead these local energy projects. Thus, the Company will establish and operate a microgrid network that will feature renewable and non-renewable energy and storage, thereby ensure reliability and reduce energy costs. To date, feasibility studies have been completed or are underway in key counties and in addition to co-development recognition by the New York Power Authority, many counties and towns are in support of Acadia Energy.

The leadership team has decades of experience managing large scale public and private projects and has partnered with leading engineering firms, core vendors, and others to build an enviable team in the clean energy systems integration industry.

Financials

As evidenced by its quarterly filings, Acadia Energy has been preparing for project commencement in upstate New York for some time. The Company has run a lean ship with a low burn rate and no long-term debt on the books. In addition to its opportunities in New York, management has explored leveraging its experience and expertise in the clean energy arena to include waste-to-energy and decarbonization projects, which could diversify future revenue streams. Moreover, as projects are launched, we believe that the Company’s replicable model could enable it to foster similar business opportunities in neighboring states. Meanwhile, given the nature of the business model, we currently forecast outsized top-line growth in 2026 and beyond, with quarterly operating profit to occur sometime in 2026. If pre-development revenues exceed our $3.8M and $12M projections for 2025 and 2026, quarterly operating margins could be north of 10% later in the year..

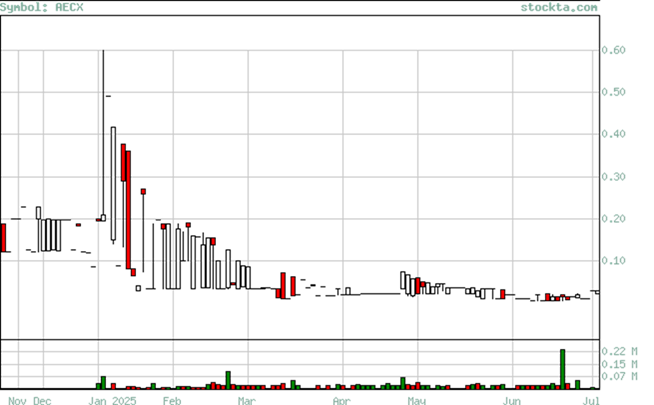

Valuation

We believe that Acadia Energy is grossly undervalued since there has been little awareness about the Company until now, when it is on the cusp of making the leap from pre-revenue to revenue generation. It is common that publicly traded companies that evolve from the pre-revenue stage to the revenue stage are afforded a major boost in valuation ahead of the evolution and can also enjoy one after the first quarterly report, if the financials are favorable. In our view, by the end of 2025, Acadia Energy will be valued based on a revenue multiple on 2026 projected sales. Given the potential variance in forecasts, and by applying a below market price/revenue multiple to be conservative, we believe that these shares could reach the $0.15 mark by year-end, reflecting a roughly 5.0x price/revenue multiple. This multiple is a reasonable target considering our projected top-line growth from 2025 to 2026. Moreover, just a few months ago, these shares traded at $0.18 when the revenue stage runway was further out. Therefore, we believe upside could exist in our target, as we get closer to year-end, with a potential trading range of $0.20 – $0.30 next year as well. Future trading ranges will be directly related to pre-development revenue from additional counties, along with specific development milestones in three counties we believe will serve as revenue generators in late 2025.

INDUSTRY OVERVIEW

Acadia Energy is well positioned to emerge as an energy integration leader by leveraging expertise in microgrid deployment and implementation. Against this backdrop, it is instructive to provide an overview of the segment and related events/projects in the U.S.

Market Size and Market Drivers

According to a report by the IMARC Group, the U.S. microgrid market is expected to grow from an estimated $7.9 billion in 2024 to $24.4 billion in 2033, a 13.3% CAGR. Various industry sources cite more than 500 operational microgrid projects while the EIA states 12 GW of battery storage was deployed by the end of 2024.

Deployment growth is being led by municipalities, remote communities, university campuses, industrial parks, hospitals, military bases, and by targeted state government mandates. By allowing towns and companies to produce and store their own electricity, microgrids lessen reliance on the main grid and cut customers’ long-term energy expenses by 20-30%. Moreover, by managing their own power supplies and demand, they can provide backup power in emergencies and not lose money for extended downtime. The operator merely disconnects from the main grid during power outages, if it integrates clean energy and storage.

Additionally, by optimizing energy use through localized management and storage, they can effectively manage peak demand and save energy expenses.

Another economic feature of microgrids is the reduction in operational costs. In an interesting quirk, a microgrid may also be able to sell excess energy back to the utility, further producing local economic benefits. Separately, commercial customers may no longer be subject to peak demand expenses, thus lowering their bills.

For those entities that utilize clean energy sources, reduced carbon emissions are generated and while it fosters goodwill locally, it can result in carbon credits as well.

As is the case with high growth, high opportunity industries, failings by other parties are driving remote communities, campuses, and others to seek out alternative or supplementary solutions to fix or avoid major critical issues. For example, extreme weather conditions and events in recent years have taxed state and local utilities. Reliable access to electricity is no longer a given as the utilities have proven to be routinely unreliable in the face of climate or weather disasters. Thus, the desire to have reliable sources of power and energy make the use of microgrids a no-brainer for local, rural communities, campuses, and managers of critical facilities. This is especially the case when clean energy sources are integrated into these large-scale projects.

On a secondary basis, innovation in management and control systems have fostered deployment as they have improved microgrid efficiency and reliability while enabling entities to meet stated sustainable energy objectives and initiatives.

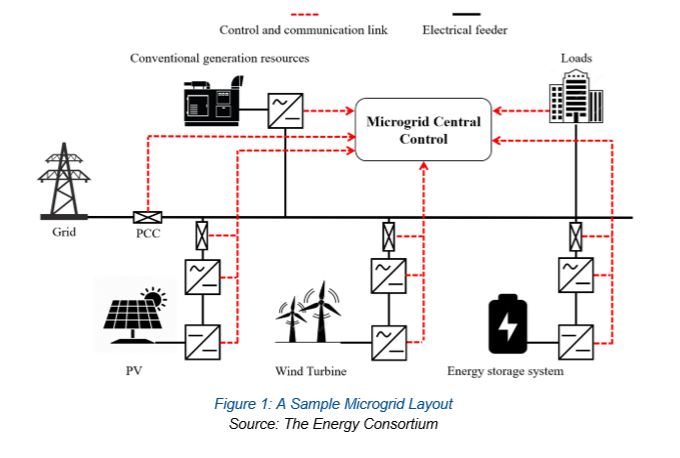

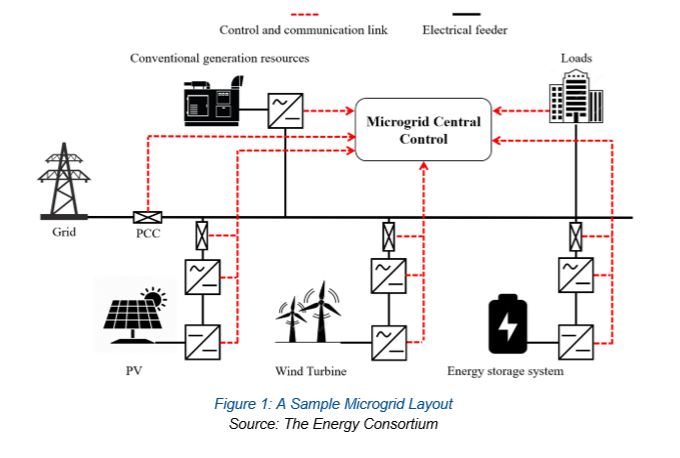

Lifting Up the Hood…

A microgrid is a small-scale, local energy system designed to operate independently or in conjunction with a local utility’s main power grid. It can include a mix of low emissions energy sources such fuel cells, geothermal, nuclear, solar panels, wind turbines, or linear generators. Users of a microgrid or group of related microgrids are typically connected through a local network. Microgrids are usually connected to the main grid or used as a backup to reduce costs and main grid stress. They are connected to clean energy storage devices to ensure reliable and sustainable electricity.

At the system level, a microgrid is managed by a microgrid controller, which is a software/hardware system. The controller monitors local energy supply and demand, balances the load, and optimizes when to use the stored energy, versus buying from the main grid.

The main players in the microgrid production space include Schneider Electric, Siemens, GE, Honeywell, Eaton and others. In addition to private operators, in places like California and New Jersey, utilities are being required to develop public-serving microgrids for critical care facilities such as hospitals or remote areas/communities. They are developed and operated by the local utilities for reasons similar to the factors we cited above. Moreover, these microgrids are deployed to meet state regulatory mandates.

The industry isn’t crazy about utilities owning distributed energy systems. Still, there are few dozens of these projects around the country as the industry remains dominated by the non-utility private sector. The overwhelming majority of these are in California, with other notable ones on the East Coast. California-based projects tend to be deployed in fire-vulnerable communities, the ones on the East Coast are often domiciled in areas hit by hurricanes and heavy storms. The State of Hawaii has a mandate to eventually engage in a 100% clean energy systems policy across the islands.

The top 5 states in the country for current microgrid project deployments are: California, New York, Texas, Massachusetts, and Alaska. In California, 85% of the electricity used by the University of California San Diego (UCSD) campus is provided via microgrids. New York has an atypical project, the Brooklyn Microgrid, whereby residents can buy/sell energy via a blockchain. Alaska has several stand-alone microgrid projects providing electricity in rural villages.

A townwide residential microgrid network can provide electricity for hundreds to thousands of customers although 100-500 daily users in a 1-5MW microgrid size is more typical, per microgrid. Interestingly, the UCSD 45MW network has 45,000 daily users with a 45MW load.

New York and Acadia Energy

The Climate Leadership and Community Protection Act (CLCPA) is New York State’s landmark climate law. Widely regarded as one of the most ambitious climate policies in the United States at the time, the CLCPA aims to dramatically reduce greenhouse gas emissions while fostering clean energy development and prioritizing environmental justice.

At its core, the CLCPA mandates that New York achieve a 40% reduction in greenhouse gas emissions by 2030 and an 85% reduction by 2050, using 1990 as the baseline year. The remaining 15% of emissions may be offset through approved methods such as carbon capture, reforestation, or other negative emissions technologies—leading to net-zero emissions economy-wide by 2050.

In the electricity sector, the law requires that 70% of electricity come from clean sources by 2030, and that the grid be entirely zero-emissions by 2040.. Another major component of the CLCPA is its emphasis on climate justice. The law requires that at least 35% (ideally 40%) of the benefits of state climate investments be directed toward disadvantaged communities, which are often disproportionately affected by pollution and economic inequality. A Just Transition Working Group was also established to guide workforce development and ensure that communities and workers impacted by the transition away from fossil fuels are supported.

We should note that comments by Governor Hochul in 2024 indicate that these objectives may be aggressive and will be adjusted. Still, the opportunity is huge.

How does Acadia Energy fit into this playing field?

There are billions of dollars in play at the federal and state level. However, as is often the case with government funding, they are always subject to revision, delays, etc. At present, the Company is exclusively focused on specific communities in Upstate New York and is well-positioned to emerge as the winner for these opportunities over the next 2-3 years. Management has spent years cultivating community relationships and partnerships with the appropriate entities and figures in the communities. Plus, the Company already meets the disadvantaged community guidelines and has been directly targeting this market. Its unique model creates jobs, spurs economic growth, and meets the objectives of the CLCPA and the underlying communities.

Finally, the Company has developed its own microgrid financial and technology platform and microgrids and as an energy systems integrator, is prepared to be agnostic with vendors, as needed.

THE BUSINESS

Acadia Energy is an innovative energy integration company focusing on design, development, funding and operation of transformative projects, spanning intelligent microgrids, and clean energy resources. Microgrids are a key component to the sustainability and modernization of our nation’s energy infrastructure. They provide resiliency, redundancy, reliability, surety and security to today’s antiquated and failing utility grid system that powers our daily lives. Acadia Energy approaches its business with a focus on sustainability and its inter-relationship with public policy.

The Company’s objective is to provide municipal governments and local communities with a reliable, lower cost of power and a continuing revenue stream. This approach can help create a pathway to attracting new commerce, job creation, sustainability and a better quality of life. Since 2016, Acadia Energy has demonstrated a deep commitment to work with local, state and federal governments to develop the critical infrastructure microgrid marketplace. Acadia Energy’s core management team has decades of experience providing mission critical solutions to government, police, fire and federal authorities and the management team leverages that expertise to collaborate with municipal partners to create next generation energy solutions.

The executive and project management team at Acadia Energy, along with key partners, have extensive development experience in designing, developing, constructing, and operating utility-scale solar projects, as well as advanced microgrids, photovoltaic solar, waste to energy, and other distributed generation resources.

Acadia Energy has been recognized by the New York Power Authority (NYPA) as a microgrid co-developer. Effective February 1, 2025, NYPA has the capability of co-developing and owning generation assets. Acadia has been selected as a co-development partner with NYPA on its pipeline of microgrid and Sustainability Hubs throughout Central New York (CNY), currently valued at over $2.0 billion.

Acadia Energy is currently in discussions with regulatory agencies such as the NY Public Service Commission (PCS), Department of Public Service (DPS), NYSERDA, and others regarding the implementation of microgrids. Although the State’s strategic CLCPA has received with an enthusiastic response within the state and around the world, many regulatory hurdles are still in place. Acadia is the first to address these hurdles and the PSC staff is addressing these issues with Acadia and its partners.

As part of its unique approach, the Acadia Energy team have worked to integrate innovative technologies into Sustainability Hubs. These sustainable environments have the potential to reduce energy costs, and support a “pure” food supply, mitigating the challenges associated with climate change, while stimulating local economies, and bringing jobs to rural communities, with a shared revenue stream.

Sustainability Hubs, when located near existing or planned industrial centers, offer a valuable asset: power that can be transmitted via private lines, avoiding costly transmission and delivery (T&D) fees that represent more than half the total energy bill. Acadia Energy can accomplish this by running its own lines from the power generation site to the end-user and amortizing the cost of delivering that power over the life of the installation, typically 25 years.

Sustainability Hubs, when located near existing or planned industrial centers, offer a valuable asset: power that can be transmitted via private lines, avoiding costly transmission and delivery (T&D) fees that represent more than half the total energy bill. Acadia Energy can accomplish this by running its own lines from the power generation site to the end-user and amortizing the cost of delivering that power over the life of the installation, typically 25 years.

The Opportunity

Through its non-profit partner, TakeChargeNY, Acadia Energy has created public-private energy models with county leadership that include properties that are suitable for green energy generation and acceptable to the community. Moreover, in partnering with county leadership, Acadia Energy ensures that the pricing of the energy generated by its Sustainability Hubs would have low income and distressed community customers in mind and would be priced based on a county/Acadia decision.

As more commercial, public sector, institutions and residents transition away from fossil fuel to power their homes and businesses, the demands on our aging electric grid become more pressing. The inevitable move to electric vehicles places even greater strains on an already-overloaded grid.

It is estimated that upgrades to the grid will cost the State of New York more than $60 billion; the first $6 billion has already been approved. Upgrades mean more than just hanging wires. Improved load management on the grid is needed. New transmission and distribution systems must be established statewide. Natural integration of multiple new sources, like Acadia’s microgrids, is part of the solution.

Unfortunately, the current situation for those in upstate New York is inequitable. Improving the carrying capacity of the grid in upstate communities does not generate goodwill when the electrons are going to power homes and businesses downstate. This is a clear case of upstate subsidizing downstate energy needs which could be curtailed under Acadia leadership with the various counties.

The Acadia Energy Advantage

Acadia Energy, in our view, is well-positioned to lead the charge on behalf of and in conjunction with Upstate New York counties. The Company and its leadership have spent nearly a decade fostering relationships in a true, public-private partnership. The unique business model has involved leadership to become embedded in the communities and demonstrate their sincere desire to improve not just power generation reliability and costs but the quality of life of the residents. No other entity has spent more time and capital in this venture. There have been “carpetbaggers” from outside of the State of New York that have stepped in to play a small role in random solar and other deployments. However, we do not believe that they are deficient when matched up against Acadia Energy.

Plus, we do not believe that other firms can demonstrate the decades of experience in large scale, complex, systems integration projects. These features are critical to success.

Our review of competing firms that also apply an energy integration approach affirm our thesis that Acadia Energy is in the catbird seat in its home state of New York. Peers such as BoxPower, Scale Microgrid, and GridAlternatives, while notable players in their own right, are unlikely to win business in Upstate New York away from Acadia Energy. These companies are not direct comps as they either are not full integrators, target tribal lands, or utilize a technology or engineering approach that may not satisfy the communities in this region. The only firm that may have an outside shot is Ameresco which has modest projects underway or operational.

The Process

Management has targeted several counties and towns that would commence later this year. Feasibility analyses have been launched or completed and each of these counties planning departments have provided Letters of Intent and Support.

Acadia Energy will work with TakeChargeNY in a collaborative manner to identify the desired service area, how the power should be allocated between residents and business, and results in a power purchase agreement amongst the stakeholders.

Once the microgrid locations have been identified Acadia Energy provides a development plan, which includes local labor agreements. One benefit to the community is the assurance that, to the extent possible, the local workforce will be utilized to complete the installation.

Acadia Energy then contracts with an experienced engineering company to perform the installation of generation sources, and interconnection with the utility in the region. Batteries, energy storage (CORESS Acadia’s proprietary storage) and fuel cells for baseload will be part of each project. This is especially important to the behind-the-meter users, such as manufacturing facilities, which rely upon steady supply of power whether the sun is out or not.

Acadia Energy will engage a leading engineering firm with experience installing clean energy infrastructure. Working with the local community, Acadia and their engineering consultant will seek to utilize the local workforce, prioritizing subcontractors from MWBE/Veterans communities.

Once the microgrid is operational, energy will be allocated according to the preferences expressed by the host county. This is defined by a percentage behind-the-meter, using power lines installed by Acadia Energy, to local institutional and industrial off-takers, as well as a percentage directed to residents (at a discounted rate to be negotiated with the prevailing utility).

Revenue generated by the facility is also apportioned according to the contract with each county. The municipal entity share can be used as they see fit. This could include a contribution to the general fund, reduction of county property taxes, or allocated towards new benefits, such as electric vehicle chargers for a school or municipal bus fleet.

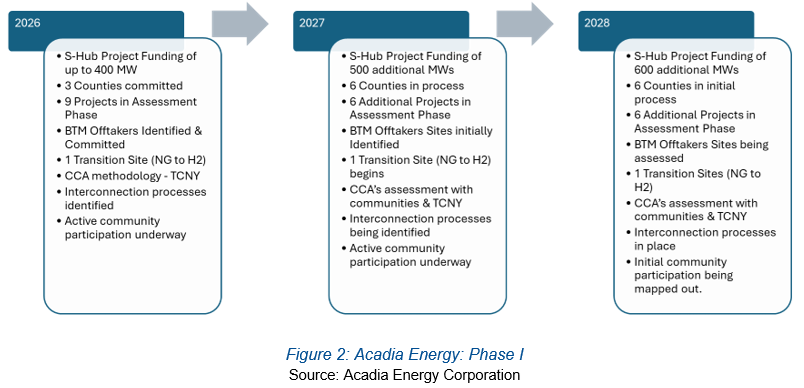

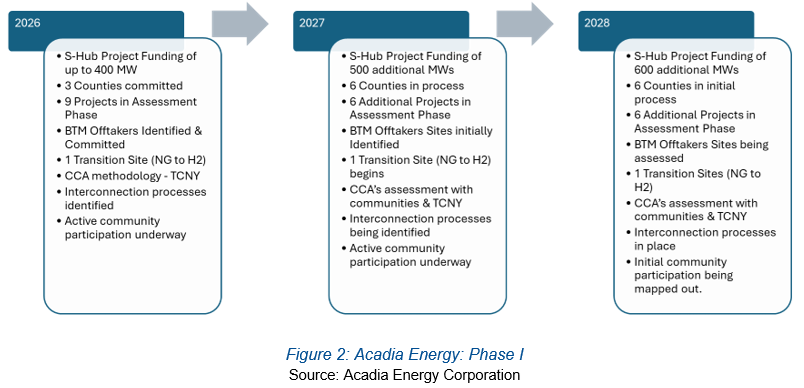

Milestones

As evidenced by the graphic below, Acadia three-year plan is highly targeted, and in our view, achievable within this timeframe. As the project reaches its various stages, we believe that the Company will take this replicable model to neighboring states and communities. In addition, management has already explored leveraging its experience in systems integration and clean energy to engage in waste-to-energy conversion projects abroad. Once again, if one of these projects commences, Acadia Energy could offer similar terms in other nations and locales, thereby diversifying its business.

FINANCIALS SNAPSHOT

There are key line items we scrutinize when reviewing pre-revenue companies and following a review of the Company’s financial statements, we believe that from a financial perspective, the Company has operated in textbook fashion—which is a major positive. The balance sheet has no long-term debt. Moreover, the largest expense is a modest $1.2M in accrued expenses—which is a small amount considering the nature of the business model. This figure is affirmed by the low quarterly burn rate of around $150,000, as outlined in the income statement as it prepares for major, future revenue closings.

Separately, we should note that Acadia is in the process of selling thousands of acres of land acquired for potential microgrid use that is no longer a viable option. Such financial transactions will be noted in future filings.

Looking ahead, we preliminarily forecast CY25 pre-development revenue of $3.8M, which reflect services performed in three NY counties. Our current expectation is that the Company could begin to operate profitably on a quarterly operating basis sometime in 2026, depending upon the timing and year-to-date scale of the project(s) implementation.

For 2026, our estimates suggest that revenue could reach $12M, reflecting more counties in the core NY project come online and other project pre-development deployments increase in size and scope. A bonus contribution could occur from a potential waste-to-energy opportunity as well. Thus, our preliminary expectation is that the Company could begin to operate profitably on a 5-10% quarterly operating basis sometime in 2026, depending upon the timing and year-to-date scale of the project(s) implementation. We would not be surprised to see revenue reach tens of millions in 2027, depending upon funding timing and scale.

While we have elected to currently provide high level revenue and operating profit to reflect variability in funding and implementation timing by its prospective customers and partners, we plan to compile a detailed, projected P&L as visibility normalizes later this year.

THE ACADIA ENERGY LEADERSHIP TEAM

The Acadia Energy management team may be one of the most dedicated groups we have encountered in recent years. Moreover, the group has a wealth of expertise and experience in key areas, and in our view, rivals that of many NASDAQ and NYSE listed companies.

John Bay, Founder, President

John founded Acadia in 2016 to originally find energy-based solutions to the economic crises he saw in his adopted home of upstate and western New York. has spent over 35 years in developing technology solutions as a system integrator. He has specialized the energy, wireless, telecommunications, application software and internet technology development creating innovative, leading-edge solutions for these markets. Previously he founded Paradigm4, a corporate enterprise with more than 240 employees, leading to the successful completion some of the country’s largest mission-critical system integration projects. He has held upper management positions throughout his career, including P&L divisional responsibilities for wireless and telecommunications at MCI WorldCom. He served on the Technical Advisory board of AT&T wireless and was instrumental in the Microsoft/Qualcomm endeavor know as Wireless Knowledge. Throughout his career, John has owned, operated, and managed corporate enterprises specializing in large, complex system integration projects and has successfully completed over $600 million in projects.

Steve Infanti, Chief Financial Officer

Mr. Infanti has had a long-distinguished career in business, development and consulting. He began his career with Coopers & Lybrand CPA’s, specializing in Construction and Manufacturing. He left public accounting to pursue interests in Construction and Development, first as a Chief Financial Officer and then as a Chief Executive Officer and co-owner of an Engineering News Record, National, Top 400 Construction Company, in the Building and Heavy Highway sectors. Mr. Infanti also has had interests in real estate development firms and partnerships, as well as other business ventures and investments. For the last 15 years, he has provided consulting services for business owners, hospitals and financial institutions as President and CEO of his business consulting company.

Mr. Infanti has also served in a leadership capacity on numerous Boards encompassing community, not for profit, healthcare and business organizations. He received a Bachelor of Science degree in accounting from LeMoyne College. He has been a certified public accountant since 1974.

Charles Schwerin, Director of Community Relations

Chuck Schwerin is a serial entrepreneur, having co-founded several medical device and biotech startups, and mentored other entrepreneurs in his role as Managing Director of Business Services at Ithaca Area Economic Development.

He holds three patents on geographic information technology and was an adjunct professor, teaching entrepreneurship at Binghamton University. Chuck is also on the Board of the Edward L. Rose Land Conservancy for whom he publishes a quarterly newsletter.

Christopher Cheney, Director of Property Management

Christopher is a proven property management professional with deep experience in real estate, economic development, and insurance. Have served on boards of directors and committees in both private and public sectors. Currently serving on the Cayuga County Public Utilities Service Agency advisory committee.

James Hibbert, Director of Investor Relations

Jim has over 30 years of experience in the Investor and Public Relations marketplace. Jim has acted directly with law firms, auditors, and investment banks on developing and filing SEC regulatory documentation utilized in the formation and uplift of companies to the OTC, NASDAQ, and other public trading platforms. He has also assisted in securing corporate financing usually required with corporate uplifts.

As Acadia’s face to the public markets, Jim’s daily activities are primarily focused on interfacing with shareholders, raising corporate awareness, and disseminating corporate news.

Dennis Elsenbeck, Advisory Consultant

Dennis provides consulting services on a broad range of energy-related opportunities encompassing a forward view of supply, distribution, and demand options. In his leadership role with a major U.S. utility for nearly 30 years, he brings insight, analytics and business perspectives on long-term policies and the economic landscape. He assists Acadia regulatory compliance on energy transactions; regulatory counseling involving Public Service Commission proceedings; energy procurement and utility negotiations involving government entities and municipalities.

RISK FACTORS

As is the case with its peers, the Company’s near-term risk is related to federal and state government funding timing and terms for the commencement of clean energy projects in upstate New York. Present uncertainty could lead to delays which would impact revenue booking timing scale and project implementation. Still, we believe that the Company is insulated from much of the current uncertainty, due in part to their technology agnostic approach. Plus, to offset challenging potentialities, management has wisely run concurrent tracks of prospective clean waste-to-energy business to include Caribbean opportunities. As these referenceable projects launch, we believe it would offset any domestic funding delays that may occur. Moreover, we believe that the international projects could lead to complementary opportunities domestically, thereby negating any funding government funding issues.

As the Company evolves from a pre-revenue stage to a meaningful revenue generation stage, Acadia Energy may need to educate or re-educate the domestic markets about the company approach benefits on a local and state level. An unforeseen customer risk could emerge such as the desire of municipalities to select a different path to executing clean energy projects, relative to current methods. Competitive risks may also include lower pricing, more effective sales/marketing, and overall greater system integration business model efficiency.

The aforementioned risks could come from larger competitors, existing firms, or new entrants. Still, these future concerns are consistent with firms of Acadia Energy’s size and standing. Moreover, we believe that the Company’s seasoned management team is prepared to overcome these hurdles and generate significant interest, leading to broad deployment and significant, future top-line growth.

Volatility and liquidity are typical concerns for microcap stocks that trade on the over the counter (OTC) stock market. Management may seek to raise funds to fund corporate development, product revenue, and overall expansion. An overriding financial benefit as a public company is the favorable access to and the availability of capital to fund product and project launches, consistent marketing campaigns and other initiatives. Since the proceeds of any future funding would be used in large part to advance development, infrastructure, and revenue, we believe that any dilutive effect from such a funding could be offset by related increases in market value.

CONCLUSION

Clean energy integrator Acadia Energy’s share price is poised for a re-valuation as it evolves from a pre-revenue firm to a meaningful revenue generator. We believe that the Company could achieve $3.8M in revenue by year-end 2025.

The Company is uniquely positioned to emerge as a major player in energy systems integration in upstate New York. Current opportunities represent tens of billions of dollars in revenue. Acadia Energy benefits from key New York state mandates. For example, a significant majority of electricity must come from clean sources. Acadia Energy owns key competitive advantages over its peers. The leadership team has spent nearly a decade fostering a true public-private partnership with counties and towns in upstate New York. Plus, management has decades of experience in large scale integration projects.

Separately, the Acadia Energy approach is a replicable model for other projects in the US. In addition, the Company is exploring other clean energy opportunities abroad, potentially diversifying the revenue base.

Our 6–12-month price target of $0.15 represents a 5.0x price/revenue multiple on 2026 forecasted revenue of $12M, a more than 200% lap from our $3.8M forecast for 2025. These shares were above our target price a few months ago, thus we believe upside exists.

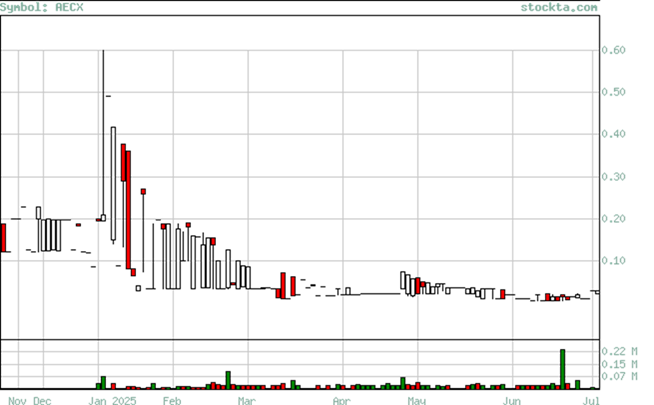

RECENT TRADING HISTORY FOR ACADIA ENERGY

(Source: www.Stockta.com)

SENIOR ANALYST: ROBERT GOLDMAN

Rob Goldman founded Goldman Small Cap Research in 2009 and has over 20 years of investment and company research experience as a senior research analyst and as a portfolio and mutual fund manager. During his tenure as a sell side analyst, Rob was a senior member of Piper Jaffray’s Technology and Communications teams. Prior to joining Piper, Rob led Josephthal & Co.’s Washington-based Emerging Growth Research Group. In addition to his sell-side experience Rob served as Chief Investment Officer of a boutique investment management firm and Blue and White Investment Management, where he managed Small Cap Growth portfolios and The Blue and White Fund.

Analyst Certification

I, Robert Goldman, hereby certify that the view expressed in this research report accurately reflect my personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the recommendations or views expressed in this research report.

Disclaimer

This Opportunity Research report was prepared for informational purposes only.

Goldman Small Cap Research, (a division of Two Triangle Consulting Group, LLC) produces research via two formats: Goldman Select Research and Goldman Opportunity Research. The Select format reflects the Firm’s internally generated stock ideas along with economic and stock market outlooks. Opportunity Research reports, updates and Microcap Hot Topics articles reflect sponsored (paid) research but can also include non-sponsored micro-cap research ideas that typically carry greater risks than those stocks covered in the Select Research category. It is important to note that while we may track performance separately, we utilize many of the same coverage criteria in determining coverage of all stocks in both research formats. Research reports on profiled stocks in the Opportunity Research format typically have a higher risk profile and may offer greater upside. Goldman Small Cap Research was compensated by the Company in the amount of $4000 for a research report production and distribution, including a press release. All information contained in this report was provided by the Company via filings, press releases or its website, or through our own due diligence. Our analysts are responsible only to the public, and are paid in advance to eliminate pecuniary interests, retain editorial control, and ensure independence. Analysts are compensated on a per report basis and not on the basis of his/her recommendations.

Goldman Small Cap Research is not affiliated in any way with Goldman Sachs & Co.

Separate from the factual content of our articles about the Company, we may from time to time include our own opinions about the Company, its business, markets and opportunities. Any opinions we may offer about the Company are solely our own and are made in reliance upon our rights under the First Amendment to the U.S. Constitution and are provided solely for the general opinionated discussion of our readers. Our opinions should not be considered to be complete, precise, accurate, or current investment advice. Such information and the opinions expressed are subject to change without notice.

The information used and statements of fact made have been obtained from sources considered reliable but we neither guarantee nor represent the completeness or accuracy. Goldman Small Cap Research did not make an independent investigation or inquiry as to the accuracy of any information provided by the Company, or other firms. Goldman Small Cap Research relied solely upon information provided by the Company through its filings, press releases, presentations, and through its own internal due diligence for accuracy and completeness. Such information and the opinions expressed are subject to change without notice. A Goldman Small Cap Research report or note is not intended as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed. This report does not take into account the investment objectives, financial situation, or particular needs of any particular person. This report does not provide all information material to an investor’s decision about whether or not to make any investment. Any discussion of risks in this presentation is not a disclosure of all risks or a complete discussion of the risks mentioned. Neither Goldman Small Cap Research, nor its parent, is registered as a securities broker-dealer or an investment adviser with FINRA, the U.S. Securities and Exchange Commission or with any state securities regulatory authority.

ALL INFORMATION IN THIS REPORT IS PROVIDED “AS IS” WITHOUT WARRANTIES, EXPRESSED OR IMPLIED, OR REPRESENTATIONS OF ANY KIND. TO THE FULLEST EXTENT PERMISSIBLE UNDER APPLICABLE LAW, TWO TRIANGLE CONSULTING GROUP, LLC WILL NOT BE LIABLE FOR THE QUALITY, ACCURACY, COMPLETENESS, RELIABILITY OR TIMELINESS OF THIS INFORMATION, OR FOR ANY DIRECT, INDIRECT, CONSEQUENTIAL, INCIDENTAL, SPECIAL OR PUNITIVE DAMAGES THAT MAY ARISE OUT OF THE USE OF THIS INFORMATION BY YOU OR ANYONE ELSE (INCLUDING, BUT NOT LIMITED TO, LOST PROFITS, LOSS OF OPPORTUNITIES, TRADING LOSSES, AND DAMAGES THAT MAY RESULT FROM ANY INACCURACY OR INCOMPLETENESS OF THIS INFORMATION). TO THE FULLEST EXTENT PERMITTED BY LAW, TWO TRIANGLE CONSULTING GROUP, LLC WILL NOT BE LIABLE TO YOU OR ANYONE ELSE UNDER ANY TORT, CONTRACT, NEGLIGENCE, STRICT LIABILITY, PRODUCTS LIABILITY, OR OTHER THEORY WITH RESPECT TO THIS PRESENTATION OF INFORMATION.

www.goldmanresearch.com

Sustainability Hubs, when located near existing or planned industrial centers, offer a valuable asset: power that can be transmitted via private lines, avoiding costly transmission and delivery (T&D) fees that represent more than half the total energy bill. Acadia Energy can accomplish this by running its own lines from the power generation site to the end-user and amortizing the cost of delivering that power over the life of the installation, typically 25 years.

Sustainability Hubs, when located near existing or planned industrial centers, offer a valuable asset: power that can be transmitted via private lines, avoiding costly transmission and delivery (T&D) fees that represent more than half the total energy bill. Acadia Energy can accomplish this by running its own lines from the power generation site to the end-user and amortizing the cost of delivering that power over the life of the installation, typically 25 years.

When we initiated coverage of Sigyn Therapeutics (OTCQB: SIGY) in March 2021, we were still in the throes of Covid-19, fears of infectious diseases, etc. However, even then, management had the vision to target a therapy to treat sepsis. Following strong in vitro data, and with improvements in the industry, Sigyn is continuing on this path, along with developing a treatment for other critically ill patients that face another condition that has a high level of mortality, end stage renal disease (ESRD) patients. In our view, milestones and events should serve as a series of valuation drivers for these shares over the next six months, and with even greater potential in the next 12-18 months.

When we initiated coverage of Sigyn Therapeutics (OTCQB: SIGY) in March 2021, we were still in the throes of Covid-19, fears of infectious diseases, etc. However, even then, management had the vision to target a therapy to treat sepsis. Following strong in vitro data, and with improvements in the industry, Sigyn is continuing on this path, along with developing a treatment for other critically ill patients that face another condition that has a high level of mortality, end stage renal disease (ESRD) patients. In our view, milestones and events should serve as a series of valuation drivers for these shares over the next six months, and with even greater potential in the next 12-18 months.  Each year, 1.7 million patients in the U.S. are stricken with sepsis, a severe condition usually contracted while in the hospital. Sepsis is the leading cause of death in U.S. hospitals and a $62 billion annual healthcare burden. Sepsis is a life-threatening condition triggered by the body’s overwhelming response to bacterial components such as endotoxin (endotoxemia) and it continues to be a major global health issue, impacting millions. If not recognized and treated promptly, sepsis can result in multiple organ failure, shock, and death.

Each year, 1.7 million patients in the U.S. are stricken with sepsis, a severe condition usually contracted while in the hospital. Sepsis is the leading cause of death in U.S. hospitals and a $62 billion annual healthcare burden. Sepsis is a life-threatening condition triggered by the body’s overwhelming response to bacterial components such as endotoxin (endotoxemia) and it continues to be a major global health issue, impacting millions. If not recognized and treated promptly, sepsis can result in multiple organ failure, shock, and death.