Innovative OKYO Pharma Has First Mover Advantage

January 30, 2025

OKYO PHARMA LIMITED

Industry: BioPharma

12 Mo. Price Target: $5.00

![]() Download Report in PDF Or Scroll down to read the complete report below.

Download Report in PDF Or Scroll down to read the complete report below.

OKYO PHARMA LIMITED

New Indication Offers Huge Potential Gains

Rob Goldman

January 30, 2025

OKYO PHARMA LIMITED (NASDAQ – OKYO – $1.07)

Industry: BioPharma

12 Mo. Price Target: $5.00

COMPANY SNAPSHOT

OKYO Pharma Limited Is a clinical stage bio-pharmaceutical company developing innovative therapies for the treatment of neuropathic corneal pain (NCP) and dry eye disease (DED), with ordinary shares listed for trading on the NASDAQ Capital Market. OKYO’s lead drug candidate OK-101 successfully completed a 240-patient Phase 2 trial in DED patients, and is also currently being evaluated in a 48-patient Phase 2 trial in NCP patients.

KEY STATISTICS

- Price as of 1/29/25

$1.07 - 52 Wk High – Low

$1.90 – $0.8080 - Est. Shares Outstanding

33.9M - Market Capitalization

$36.3M - Average Volume

59,050 - Exchange:

NASDAQ

COMPANY INFORMATION

OKYO Pharma Limited

14-15 Conduit Street

London W1S 2XJ

United Kingdom

Web: www.OKYOPharma.com

Email: info@okyopharma.com

Phone : 917.497.7560

INVESTMENT HIGHLIGHTS

OKYO Pharma is focused on developing OK-101 to treat NCP which presently has no FDA approved drug to treat this debilitating ocular disease. OKYO Pharma commenced its Phase 2 trial of OK-101 in October 2024 and results are expected by year-end 2025.

OKYO is the first company to be granted an investigational new drug (IND) application for NCP by FDA for clinical trials in NCP patients, and the first company to launch a clinical trial in NCP patients specifically diagnosed with NCP. This trial is on the heels of a favorable DED Phase 2 trial of OK-101 which notably demonstrated statistical significance in an ocular pain secondary endpoint.

The potential size of the NCP market assuming NCP receives Orphan Drug designation is $6.4 billion. The market opportunity for the first drug to receive FDA approval to treat this major unmet medical need is based on a 160,000 US potential patient size.

We believe that given its positioning, and assuming data are favorable, OKYO will likely also attract a potential joint venture development partner or an acquirer by 2026/2027. We believe the results from this trial represent a major binary event, serving as a critical catalyst for a re-valuation of the stock.

Our 12-month, pre-data release price target for OKYO is $5.00. This target is based on the prospective value of OK-101, projected sales multiples discounted back four years, and the median valuation of ocular biopharma M&A deals.

COMPANY OVERVIEW

We initiated coverage of London-based OKYO Pharma Limited (NASDAQ: OKYO) on May 9, 2023. OKYO is a biotechnology company focused on the discovery and development of novel molecules to treat inflammatory ocular diseases and ocular pain. OKYO’s lead drug candidate OK-101, which is presently in clinical development, is administered topically to the eye and was first developed to treat dry eye disease (DED), an estimated $5.5 billion global market. The Company has achieved significant development milestones since our original report was published. In fact, OKYO may have discovered a first-of-its-kind treatment for a debilitating ocular pain condition called neuropathic corneal pain (NCP) that has no FDA approved drug. A Phase 2 clinical trial for NCP commenced in October 2024 with results slated to be released by year-end 2025. If results are favorable, we believe it will serve as a key catalyst to drive prospective M&A for the Company, and power OKYO’s share price to our updated 12-month price target of $5.00.

Development of OKYO’s Lead Clinical Drug OK-101

OK-101 was developed using a membrane-anchored-peptide (MAP) technology to produce a novel long-acting drug candidate for treating ocular front-of-the-eye diseases. OK-101 is a lipid conjugated chemerin peptide agonist of the ChemR23 G-protein coupled receptor which is typically found on immune cells of the eye and neurons and glial cells found on the dorsal root ganglion. ChemR23 is generally recognized as being responsible for the inflammatory response. OK-101 was shown to produce anti-inflammatory and pain-reducing activities in mouse models of both dry eye disease and a neuropathic corneal pain animal model; and is designed to combat washout through the inclusion of the lipid ‘anchor’ contained in the candidate drug molecule to enhance the residence time of OK-101within the ocular environment.

Brilliant Pivot by OKYO Management

Most observers and clinicians would characterize the current DED market’s seven FDA-approved products as subpar, or underwhelming. There are issues with efficacy, slow onset of action and a plethora of side effects. In the beginning of 2024, OKYO released top-line data from the placebo controlled, randomized, multi-center, multi-arm, Phase 2 clinical trial of OK-101 to treat DED. The data from the trial demonstrated that OK-101 showed statistically significant reduction in a number of secondary endpoints, including ocular burning/stinging, blurred vision, and of particular importance, ocular pain. Recognizing that patients with DED are prone to suffer from NCP, as well as the earlier positive neuropathic corneal pain animal model results, the Company had begun the process of filing an IND for OK-101 to treat NCP, a debilitating condition for which there is no FDA approved drug. Armed with these data, OKYO management elected to pivot from a DED-centric treatment approach to the NCP space where the Company carries first-mover advantage. In February 2024, FDA cleared an IND for OK-101 for NCP. OKYO is the first company to be granted an IND to treat NCP, a major unmet medical need. And on October 23, 2024, OKYO announced the dosing of the first patient in a Phase 2 trial of OK-101 to treat NCP. OKYO is the first company to enroll patients in a clinical trial designed to enroll patients specifically diagnosed with the NCP condition.

The size of the NCP market has not been fully established, due in part to the sophisticated equipment required to diagnose the condition. Since it is not widely available, we have applied a preliminary patient size range in the US only. According to the National Eye Institute, 16.4 million Americans suffer from DED. Our current patient size range of 160,000 represents 1% of the US DED market. Using an estimated (low) annual patient cost of $40,000 for an approved OK-101 for NCP, we arrive at a potential market size of $6.4 billion.. As indicated by these figures, the receipt of a potential Orphan Drug Designation by the FDA for its drug candidate could be significant. However, it is possible that in future years, as patients can be tested on a wider scale, the patient figure may reach a level that exceeds the sub-200,000 patient figure required to maintain Orphan Drug designation.

We expect a series of milestones including enrollment updates to favorably impact OKYO’s shares throughout the year. For example, the Company anticipates completing enrollment of the 48-patient trial by the end of 2Q 2025.

Valuation

Given that the Company is primed to reach a key valuation-changing milestone with the release of Phase 2 data for NCP at year-end, we have elected to publish a price target that we believe could be achieved in the next 12 months. If multi-dose data and efficacy match OKYO’s primary and secondary objectives, we believe that these data could serve as a catalyst for a mid-tier – to top tier pharmaceutical firm to seek to enter into a transaction with OKYO. This transaction could be in the form of M&A or an investment and related licensing or partnership arrangement with OKYO in exchange for future R&D. We believe that given the safety profile, a compassionate care usage profile could be granted by the FDA, thereby enabling OKYO and a potential partner to benefit. Moreover, due to the nature of OK-101’s chemistry, administration, and its first-mover advantage, we strongly believe that the Company’s OK-101 (and a partner or an acquirer) could be well positioned to be the first FDA approved topical solution for the treatment of NCP.

Against this backdrop, in 2026, we envision a potential investment of millions for future R&D, with additional funds to be invested based on R&D and other milestones, and a potential right to acquire a majority stake in or an outright purchase of OKYO.

Our 12-month, pre-data release price target is $5.00 and is designed to reflect the potential valuation assessed following a successful Phase 2 trial for a first mover product slated to treat an unmet need that represents a large market opportunity. We believe that in 2026/2027, when a deal with a partner could occur, the Company would benefit from a re-valuation of these shares. This price target is affirmed by a future valuation estimate. This estimate assumes $75M in annual CY2029 sales for an FDA-approved OK-101 and an assigned 6.5x sales multiple, which represents a slight discount to the median multiple assigned to a series of ocular M&A transactions. We thus arrive at a future potential $487M valuation in an acquisition. Our 12-month price target of $5.00 reflects this figure discounted back four years at a rate of 30%, on a Net Present Value basis.

THE DED MARKET

[Analyst’s Note: While the objective of this report is to inform readers regarding the untapped potential of the NCP indication, it is important to note both the success of the OKYO trial and the fact that NCP patients are a combination of a subset of DED patients along with patients who develop the disease due to other causes such as surgery and ocular injury.]

Dry eye disease, or keratoconjunctivitis sicca, is a common and often chronic problem, particularly in older adults. With each blink of the eyelids, tears spread across the front surface of the eye, known as the cornea. Tears provide lubrication, reduce the risk of eye infection, wash away foreign matter in the eye and keep the surface of the eyes smooth and clear. Excess tears in the eyes flow into small drainage ducts in the inner corners of the eyelids, which drain into the back of the nose.

People with dry eyes either do not produce enough tears or their tears are of a poor quality due to a deficient tear film lipid layer, which increases tear evaporation. Advanced dry eyes may damage the front surface of the eye and impair vision. Dry eyes can develop for many reasons, including age, gender, medications, medical conditions, and other factors. Tear film instability triggers chronic inflammation of the ocular surface which leads to symptoms of constant pain, itchiness, burning, visual impairment, etc.

DED affects more than 35% of people aged 50+, with women representing two-thirds of this segment. One reason why this segment may be more predisposed than men could be related to hormonal changes that occur after menopause. These hormonal changes affect the quantity and quality of the tear film, or layer of tear fluid that protects the eye.

The prevalence of dry eye is expected to increase substantially going forward due to an aging population and the increased use of contact lenses and digital screen time. On a global basis, the DED market is expected to grow from $5.2B in 2019 to $6.54B in 2027, according to Fortune Business Insights. The US market is projected to be around $2.4B.

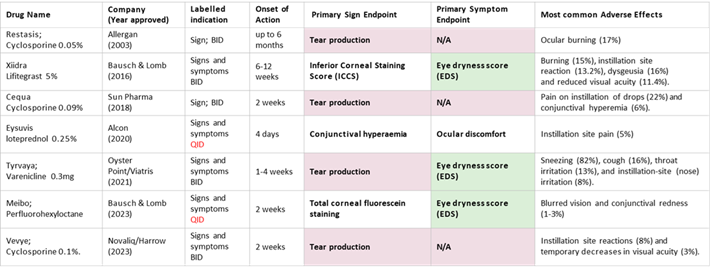

Below is a table of the leading approved DED drugs and their producers, who, in our view, could serve as potential OKYO partners.

THE OKYO DIFFERENCE

History

Tracing its roots to 2018, OKYO is a biopharmaceutical company developing next-generation therapeutics to improve the lives of patients suffering from inflammatory eye diseases and ocular pain. Its research program is focused on a novel G Protein-Coupled Receptor, or GPCR, which management believes plays a key role in the pathology of inflammatory eye diseases representing high unmet medical need. OKYO’s therapeutic approach is focused on targeting inflammatory and pain modulation pathways that drive these conditions. OKYO is presently developing OK-101, its lead clinical product candidate, for the treatment of neuropathic corneal pain (NCP). The Company is also evaluating its potential in benefiting patients with dry eye disease (“DED”).

In 2018, OKYO successfully obtained (via assignment from Panetta Partners Limited, a related party) an exclusive license from On Target Therapeutics (OTTx) to patents owned or controlled by OTTx and a sub-license from OTTx to certain patents licensed by OTTx from Tufts Medical Center (TMC) to support its ophthalmic disease drug programs. These licenses gave OKYO the right to exploit the IP estate which is directed to compositions-of-matter and methodologies for treating ocular inflammation such as DED with lipid-linked chemerin analogues. OKYO also has a license from TMC to a separate IP estate for treating symptoms of neuropathic corneal pain, uveitis and associated pain. The scope of the TMC IP granted use through the sublicense with OTT is commensurate with the scope of use of the IP granted to OTT from TMC. This intellectual property, which includes 3 key patents on OK-101, covering areas including technology, dry eye, and neuropathic corneal pain, forms the intellectual property basis of OKYO’s OK-101 program.

The Science

The development of new drugs to treat DED has been particularly challenging due to the heterogeneous nature of the patient population suffering from DED, and due to the difficulties in demonstrating an improvement in both signs and symptoms of the disease in well-controlled clinical trials. OK-101 is designed to target a chemokine-like receptor 1, or CMKLR1, or CHEMR23, which is a G protein-coupled receptor expressed on macrophages, neutrophils, monocytes, plasmacytoid/myeloid dendritic cells, natural killer cells and nonhemopoietic cell types, such as endothelial and epithelial cells as well as neurons and glial cells in the dorsal root ganglion, and retina. Activation of CMKLR1 by its endogenous peptide ligand chemerin is known to generate a pro-inflammatory response, and peptide fragments of chemerin have been discovered to generate the opposite, producing an anti-inflammatory response. However, natural ligands for CMKLR1 have short half-lives due to rapid inactivation. Development of OK-101, a stable, high potency CMKLR1 agonist provided an important step toward the development of a new class of anti-inflammatory and anti-ocular pain therapeutics that can be applied to the treatment of ophthalmic diseases including NCP and DED.

OK-101: DED Trial

In July,2024 OKYO announced:

“…promising new categorical data analyses from the recent OK-101 Phase 2 trial in DED patients. These analyses have identified conjunctival staining and ocular pain as the highest potential “sign” and “symptom” co-primary endpoints to be explored in the next DED trial of OK-101. The data from this first in-human trial of OK-101 in patients with DED has established a clear road map for future clinical development in this indication. Through our analytical work we have concluded that conjunctival staining and ocular pain represent important and de-risked endpoints to be studied further to help underserved patients whose dry eye symptoms include a pain component. Furthermore, this trial demonstrated a favorable tolerability profile for OK-101, with an excellent eyedrop comfort score for a topically administered drug.”

“Notably, the number of patients showing both a reduction in conjunctival sum staining and in the pain symptom in the OK-101-treated group was 34.2% compared to 20.3% in the placebo-treated group, a 68% improvement. Similarly, the number of patients with reduction in conjunctival sum staining and burning/stinging symptoms were also numerically higher in the OK-101-treated group (32.9%) compared to the placebo-treated group (20.3%), with a 62% improvement.”

This Phase 2 trial featured 240 patients diagnosed with DED.

OK-101: NCP Trial

OK-101’s IND, which was cleared by FDA in February 2024, is the first IND granted by FDA to treat patients with NCP. OKYO announced the start of the OK-101 NCP trial with the announcement of dosing of the first patient in October 2024. Notably, the Company announced that OK-101 was the first drug candidate to enroll patients specifically diagnosed with NCP in a clinical trial. This trial is designed as a randomized, placebo-controlled, double-masked study to treat 48 NCP patients. The trial has three arms, utilizing 0.05% OK-101 along with 0.1% OK-101 and placebo, (16 patients per arms). The protocol calls for 5 visits over the course of 16 weeks, with a study duration of an expected 9-12 months. Pedram Hamrah, MD, one of the leading authorities on NCP in the US is the trial’s Principal Investigator which is being conducted at the Tufts Medical Center in Boston. Given the favorable safety profile, previous data, first-mover advantage and the ease of a topical administration, it is easy to be favorably disposed toward a positive outcome later this year.

What is Neuropathic Corneal Pain?

The publication Nature published an in-depth clinical paper on NCP and both its description and findings scream for the need to treat sufferers, some of whom have become suicidal as a result of the condition. The text below features excerpts from both the abstract and introduction. I have highlighted critical points for convenience. The link to the full document is found below.

“Corneal neuropathic pain (CNP) is a poorly defined disease entity characterised by an aberrant pain response to normally non-painful stimuli and categorised into having peripheral and central mechanisms, with the former responding to instillation of topical anaesthetic. CNP is a challenging condition to diagnose due to numerous aetiologies, an absence of clinical signs and ancillary tests (in vivo confocal microscopy and esthesiometry), lacking the ability to confirm the diagnosis and having limited availability. Symptomatology maybe mirrored by severe and chronic forms of dry eye disease (DED), often leading to misdiagnosis and inadequate treatment. In practice, patients with suspected CNP can be assessed with questionnaires to elicit symptoms. A thorough ocular assessment is also performed to exclude any co-existent ocular conditions. A medical and mental health history should be sought due to associations with autoimmune disease, chronic pain syndromes, anxiety and depression. Management begins with communicating to the patient the nature of their condition. Ophthalmologists can prescribe topical therapies such as autologous serum eyedrops to optimise the ocular surface and promote neural regeneration. However, a multi-disciplinary treatment approach is often required, including mental health support, particularly when there are central mechanisms. General practitioners, pain specialists, neurologists and psychologists may be needed to assist with oral and behavioural therapies. Less data is available to support the safety and efficacy of adjuvant and surgical therapies and the long-term natural history remains to be determined. Hence clinical trials and registry studies are urgently needed to fill these data gaps with the aim to improve patient care.”

“Corneal neuropathic pain (CNP) is being increasingly recognised, particularly in patients with a diagnosis of dry eye disease (DED) [1], for its impact on a patient’s quality of life [2, 3]. The impacts can be mild with minimal effects on activities of daily living to severe with the patient experiencing debilitating symptoms that can lead to a deterioration in their physical and social well-being [4]. Reports have emerged of its occurrence and burden following cataract and refractive surgery [5,6,7] and in those with neurotrophic keratopathy [8], chronic pain syndromes [9, 10] and autoimmune diseases [11, 12]. The overarching feature of CNP is a heightened experience of pain without commensurate clinical signs [4, 13, 14].”

A range of symptoms can be produced by CNP with many overlapping those of DED, such that it is frequently misdiagnosed as dry eye [13, 18].

https://www.nature.com/articles/s41433-024-03060-x

Since DED patients can also suffer from neuropathic corneal pain, it can conceivably make those patients more resistant to anti-inflammatory drugs. Hence, those DED patients suffering from NCP would also benefit from a drug that comprises both anti-inflammatory and neuropathic pain-reducing characteristics. Enter OKYO. The ChemR23 receptor on leukocytes targeted by OK-101 was also shown to be expressed on neurons and glial cells in the dorsal root ganglion and spinal cord. Recent data utilizing a mouse model of NCP demonstrated that OK-101, given topically to the eyes of mice, was able to reduce neuropathic pain in these animals. These as well as other data in animal models and in in vitro studies indicate that topically administered OK-101 peptide is capable of not only producing an anti-inflammatory response but also capable of reducing neuropathic corneal pain. Thus, OK-101 may be well-positioned to improve the quality of life of NCP sufferers. Hence, OK-101 serves as a potentially promising candidate for the treatment of both inflammation and pain for those suffering from NCP.

The present size of the NCP market will ultimately depend on whether this disease is accorded orphan disease status by FDA. Strict diagnosis for NCP presently requires a microscopic technique called confocal microscopy for directly imaging the ocular nerves to determine nerve damage. Since this technique is not widely available by ophthalmologists, there is presently no accurate measure of the number of people with the condition. To make an estimate of the NCP market size, we have applied a preliminary patient size range in the US only. According to the National Eye Institute, 16.4 million Americans suffer from DED. Our current patient size range of 160,000 represents 1% of the US DED population.

It is possible that the winds may be in OKYO’s favor. First, OK-101 to treat NCP may be designated as an Orphan Drug if it is found by the FDA to have fewer than 200,000 patients with the condition. Given the gray area outlined above and affirmed in the Nature piece, OKYO stands a good chance to be granted such designation. It could potentially lead to outsized pricing, if and until a re-assessment of the figures occurs whereby pricing might normalize.

This assumes an FDA approval, of course. Another wind at OKYO’s back is the fact that a compassionate care usage may be in order at some point due to the quality-of-life issues and suicide rates due to the debilitating condition, etc.

Using an estimated (low) annual patient cost of $40,000 for an approved OK-101 for NCP with an Orphan Drug Designation, we arrive at a potential market size of $6.4 billion, at the lower patient level. As indicated by these figures, the receipt of a potential Orphan Drug Designation by the FDA for its drug candidate could be significant. However, we also take the approach that in future years, as patients can be tested on a wider scale, the 2% or higher figure may evolve as an accurate patient estimate, albeit with a potentially, slightly lower cost for the topical solution.

THE OKYO PHARMA LEADERSHIP TEAM

In our view, the OKYO team is an enviable one, given the strength of its members’ history of success in their respective industries.

Gabriele Cerrone, Non-Executive Chairman

Mr. Cerrone has a successful track record and extensive experience in the financing and restructuring of micro-cap biotechnology companies. He has founded ten biotechnology companies in oncology, infectious diseases and molecular diagnostics, and has taken nine of these companies to the NASDAQ Market and two to the Main Market and AIM Market in London. Mr. Cerrone is Executive Chairman and Founder of Tiziana Life Sciences plc (NASDAQ: TLSA) a neuroinflammatory focused therapeutics company. Mr. Cerrone also co-founded Cardiff Oncology, Inc. (NASDAQ: CRDF), an oncology company and served as its Co-Chairman; he was a co-founder and served as Chairman of both Synergy Pharmaceuticals, Inc. (NASDAQ: SGYP) and Callisto Pharmaceuticals, Inc. (AMEX: CLSP), and was a Director of and led the restructuring of Siga Technologies, Inc. (NASDAQ: SIGA). Mr. Cerrone also co-founded FermaVir Pharmaceuticals, Inc. and served as Chairman of the Board until its merger in September 2007 with Inhibitex, Inc. Mr. Cerrone served as a director of Inhibitex, Inc. until its US$2.5bn sale to Bristol Myers Squibb Co in 2012.

Mr. Cerrone is also the Co-Founder of Rasna Therapeutics Limited (OTCMKTS: RASP), a company focused on the development of therapeutics for leukaemias; Co-Founder of Hepion Pharmaceuticals, Inc. (Nasdaq: HEPA); Executive Chairman and Co-Founder of Gensignia Life Sciences, Inc., a molecular diagnostics company focused on oncology using microRNA technology; and Executive Chairman and founder of Accustem Sciences plc; and founder of BioVitas Capital Ltd.

Gary S. Jacob, PhD, Chief Executive Officer

Dr. Jacob has over 35 years of extensive experience in the pharmaceutical and biotechnology industries across multiple disciplines, including research and development, operations, business development, capital financing activities and senior management expertise. He has developed broad and influential contacts throughout the biopharmaceutical, financial, banking and investor communities. Dr. Jacob is the Co-Founder and former CEO and Chairman of Synergy Pharmaceuticals. During his time at Synergy, he served as Chairman, Chief Executive Officer and Executive Chairman, and is the co-inventor of Synergy’s FDA-approved drug Trulance® which is currently marketed in the U.S. by Bausch Health, Inc. to treat functional GI disorders. Dr. Jacob is also the former CEO and Managing Director of Immuron Inc., an Australian biotechnology company dual-listed on the Australian ASX exchange and on NASDAQ, as well as the former Chairman of the Board of Hepion Pharmaceuticals, Inc., a public NASDAQ listed company. He is currently a board member of Actavia, a public biotechnology company, and was also on the Board of Directors of Cardiff Oncology, Inc., a NASDAQ listed public oncology company. He served as Chief Executive Officer and Director of Callisto Pharmaceuticals, Inc. from May 2003 until January 2013.

Prior to his involvement with Callisto and Synergy, Dr. Jacob was at Monsanto/G.D. Searle, where he was Director of Glycobiology and a Monsanto Science Fellow, specializing in the field of Glycobiology and drug discovery. Dr. Jacob holds over 30 patents and is the co-inventor of two pharmaceutical drugs which are FDA approved. Dr. Jacob earned a B.S. cum laude in Chemistry from the University of Missouri, St. Louis and holds a Ph.D. in Biochemistry from the University of Wisconsin, Madison.

Raj Patil, PhD, Chief Science Officer

Dr. Patil brings 30 years of ophthalmic experience and a powerful combination of academic scholarship and pharmaceutical R&D excellence.

Dr. Patil previously worked with Ora Inc, as Vice President of Research & Development, where he was responsible for driving all anterior and posterior segment research of Ora’s R&D Institute. Earlier in his career, he worked at iVeena Delivery Systems as Vice President of Advanced Ocular Delivery Systems. His tenure at iVeena included a two-year sabbatical in Singapore, where he served as an Associate Professor of Ophthalmology at DUKE/NUS Medical School and Principal Investigator at Singapore Eye Research Institute.

Dr. Patil also held a number of leadership roles at Alcon/Novartis Institute of Biomedical Research, including Associate Director of Research and Head of Molecular Pharmacology glaucoma and retina research. Prior to joining the business world, Dr. Patil served as an Associate Professor of Ophthalmology, Cell Biology & Genetics at the University of Nebraska Medical Centre in Omaha and as an Assistant Professor of Ophthalmology, Molecular Biology & Pharmacology at Washington University in St. Louis.

Dr. Patil received his PhD in Biochemistry from the National Chemical Laboratory/University of Pune, India and completed his postdoctoral training in Biochemistry and Molecular Biology at the University of Michigan, Ann Arbor, MI. He is the recipient of the Olga Keith Wiess Special Scholar Award from the Research to Prevent Blindness Foundation, and a NIH Director’s New Innovator Award. Dr. Patil has authored over 50 peer-reviewed research articles and serves as a reviewer and editorial board member for numerous journals and is frequently invited to lecture at academic and industry events.

Keeren Shah, Chief Financial Officer

Keeren Shah serves as our Chief Financial Officer. Ms. Shah currently also serves as the Finance Director of Tiziana Life Sciences LTD, Accustem Sciences Limited and Rasna Therapeutics Inc., having previously served as the Group Financial Controller for all businesses from June 2016 to July 2020. Prior to joining the Company, Ms. Shah spent 10 years at Visa, Inc. as a Senior Leader in its finance team where she was responsible for key financial controller activities, financial planning and analysis, and core processes as well as leading and participating in key transformation programmes and Visa Inc.’s initial public offering. Before joining Visa, Ms. Shah also held a variety of finance positions at other leading companies including Arthur Andersen and BBC Worldwide. She holds a Bachelor of Arts with honours in Economics and is a member of the Chartered Institute of Management Accountants.

Willy Simon, Non-Executive Director

Willy Jules Simon is a banker and worked at Kredietbank N.V. and Citibank London before serving as an executive member of the Board of Generale Bank NL from 1997 to 1999 and as the chief executive of Fortis Investment Management from 1999 to 2002. He acted as chairman of Bank Oyens & van Eeghen from 2002 to 2004. Willy Simon has been the chairman of Bever Holdings, a company listed in Amsterdam, since 2006 and Chairman of Ducat Maritime since 2015. He is also a non-executive director of Tiziana Life Sciences plc.

John Brancaccio, Non-Executive Director

Mr. Brancaccio, a retired CPA, is a financial executive with extensive international and domestic experience in pharmaceutical and biotechnology for privately and publicly held companies. From 2000 to 2002, Mr. Brancaccio was the Chief Financial Officer/Chief Operating Officer of Eline Group, an entertainment and media company. From May 2002 until March 2004, Mr. Brancaccio was the Chief Financial Officer of Memory Pharmaceuticals Corp., a biotechnology company. From April 2004 until May 2017, Mr. Brancaccio was the Chief Financial Officer of Accelerated Technologies, Inc., an incubator for medical device companies. Mr. Brancaccio is currently a director of Cardiff Oncology, Inc., Hepion Pharmaceuticals, Inc., Rasna Therapeutics, Inc., and Tiziana Life Sciences plc.

Bernard Denoyer, Non-Executive Director

Bernard F. Denoyer has 49 years of financial management experience including his service as Senior Vice President, Finance and Secretary of development stage Synergy Pharmaceuticals, Inc, from July 2008 until FDA approval and his retirement in June 2017. Between 2004 and January 2013 Mr. Denoyer concurrently served as Principal Financial Officer of Synergy’s former parent company, Callisto Pharmaceuticals, Inc. From October 2000 to December 2003, Mr. Denoyer was an independent consultant. Prior to this, Mr. Denoyer served as Chief Financial Officer and Senior Vice President of META Group, Inc. Mr. Denoyer earned his CPA with Ernst & Young in 1975. He received a master’s Certificate of Accounting from the Kellogg Graduate School of Management in 1974, an MBA in Finance with honours from Columbia Business School in 1972 and a BA in Economics from Fairfield University in 1969. Mr. Denoyer is fluent in French and studied in Paris at l’Istitut d’Etude Politique et Economique in 1968. He is currently serving on the Board of Trustees for two not-for-profits, St. Edmunds Retreat, Inc. and Midwestern Connecticut Council on Alcoholism, Inc.

SCIENTIFIC ADVISORY BOARD

Napoleone Ferrara, MD, Board Member

Dr. Ferrara is a Professor at the University of California San Diego Medical Center and a member of The National Academy of Sciences and has received numerous prestigious awards, including the Lasker Award and the Breakthrough Prize in Life Sciences. His research on understanding the role of angiogenesis and vascular endothelial growth factor (VEGF) in cancer development, led to the discovery that VEGF is a key mediator of angiogenesis associated with intraocular neovascular syndromes. This pioneering research led to the clinical development of a humanized anti-VEGF Fab (Ranibizumab, Lucentis®), which has also been approved as a therapy for neovascular age-related macular degeneration (AMD), retinal vein occlusion and diabetic macular edema. Ranibizumab and other anti-VEGF agents have had a dramatic impact on the development of therapies for these blinding disorders. When Lucentis® (Ranibizumab) received FDA approval in late June 2006, the new macular degeneration drug was celebrated as a major medical breakthrough. Dr. Ferrara’s research also led to the development and approval of humanized anti-VEGF mAbs (Bevacizumab; Avastin®) for cancer treatment, with Avastin® being one of the bestselling cancer drugs over the last two decades. Lucentis® and Avastin® collectively achieved over $9 billion in sales last year.

Pedram Hamrah, MD, FRCS, FARVO, Board Member

Pedram Hamrah, MD is Co-Director of the Cornea Service and Director of the Center for Translational Ocular Immunology at New England Eye Center at Tufts Medical Center in Boston. Dr Hamrah’s research interests focus on corneal immunology and neuroscience, ocular imaging (immuno-imaging), ocular surface diseases and corneal neuropathic pain. He is currently on faculty at the departments of Ophthalmology and Bioengineering at Tufts University, where he is the director of clinical research and director of the Center for Translational Ocular Immunology. In addition, he is a faculty member at the immunology, neuroscience, and cell, molecular and developmental biology graduate programs at the Sackler School of Graduate Biomedical Sciences at Tufts. Throughout his career, he has focused on discovery, patient care and teaching. Dr. Hamrah currently serves on over a dozen editorial boards, is the associate editor for The Ocular Surface and TVST, section editor for Eye and assistant editor at Ocular Immunology and Inflammation.

Jay S. Pepose, MD, PhD, FARVO

Dr. Pepose, a specialist in refractive surgery and corneal and external diseases, is the founder and Medical Director of the Pepose Vision Institute and held the Bernard Becker Chair in Ophthalmology and Visual Sciences at Washington University School of Medicine in St. Louis. He is a consultant to numerous ophthalmic drug and device companies and serves as a Director and Chief Medical Advisor for Ocuphire Pharma. Dr. Pepose has been involved in over 40 clinical research trials, including registration trials for dry eye drugs, and has been the recipient of R-01 grant support from the National Eye Institute. He has served on the editorial boards of numerous prestigious journals, including the American Journal of Ophthalmology, Investigative Ophthalmology & Visual Science (IOVS), Cornea, and The Journal of Refractive Surgery and has over 200 peer reviewed publications. Dr. Pepose, an ARVO Gold Fellow, is a recipient of the Cogan Award from the Association for Research in Vision and Ophthalmology (ARVO) and the Life Achievement Honor Award from the American Academy of Ophthalmology. Dr. Pepose received an A.B. and M.A. in neurophysiology from Brandeis University and completed the M.D.-Ph.D. program at UCLA School of Medicine. He completed ophthalmology residency at the Wilmer Institute at the Johns Hopkins Medical Center and fellowship training at Georgetown University Medical Center.

Victor Perez, MD

Dr Victor Perez is a Director of Cornea Research at Bascom Palmer Eye Institute, at the University of Miami Miller School of Medicine. He is a clinician-scientist investigator in the field of ocular immunology and ocular surface diseases and served as Director of Duke Eye Center’s Ocular Immunology Center before joining Bascom Palmer Eye Institute.

Anat Galor, MD

Dr. Anat Galor is a cornea and uveitis trained specialist with dual appointments at the Bascom Palmer Eye Institute and the Miami VA medical center. Dr. Galor completed an ophthalmology residency at the Cole Eye Cleveland Clinic, a uveitis fellowship at the Wilmer Eye Institute, and a cornea and external diseases fellowship at Bascom Palmer Eye Institute. Dr. Galor currently runs the ocular surface pain program at the Bascom Palmer Eye Institute and the Miami VA and has focused her research on understanding mechanisms of pain in dry eye, with an emphasis on studying new diagnostic and treatment modalities.

Mark Milner, MD

Dr. Mark Milner is Director of Cornea at Goldman Eye in Palm Beach Gardens, Florida with a focused interest in dry eye disease and dysfunctional tear syndrome. Dr. Milner completed his ophthalmology residency at the New York Eye and Ear Infirmary and his fellowship in cornea, external disease and uveitis at Francis I. Proctor Foundation at the University of California, San Francisco. Dr. Milner served as an Associate Clinical Professor at Yale University Medical School, Department of Ophthalmology, and was previously the Director of the Cornea Clinic at The Veterans Administration Medical Center in West Haven, CT.

FINANCIALS SNAPSHOT

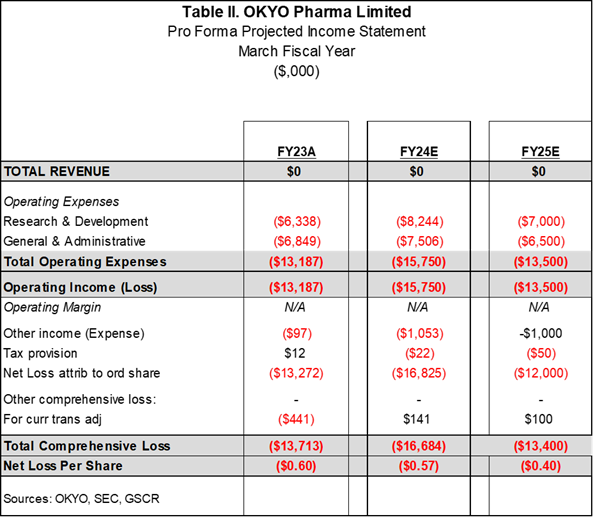

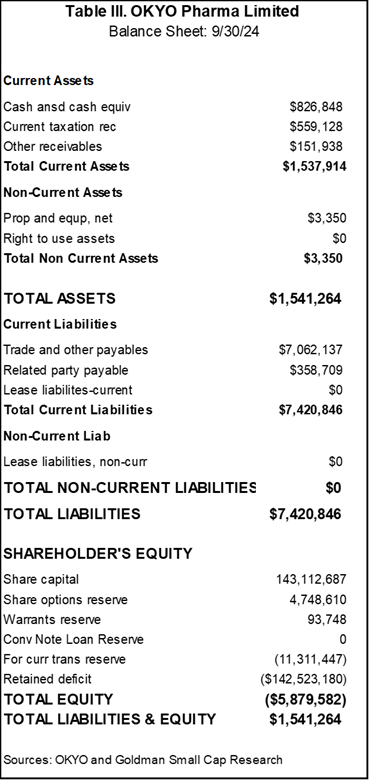

Given that OKYO is pre-revenue and has a lean infrastructure, line items in the P&L are few, as they generally just encompass research and development and general and administrative expenses. The Company has a March fiscal year and we have endeavored to project expenses to coincide with the continuation and conclusion of the Phase II trial. It should be noted that OKYO plans to raise funds this year to complete the cost of the clinical trial, which is lower than many in this industry segment. A $1.4M non-dilutive funding occurred on January 21, 2025, which is a great shot in the arm.

Going forward, we believe that the final trial results will be available at year-end 2025 and that a subsequent Phase III registration trial should likely commence within the next 6 months after this trial. At this juncture, we preliminarily forecast that a filing of a new drug application on OK-101 to treat NCP could occur by end of 2007, with marketing approval by late 2028. Given the chronic nature of NCP, we deem it possible that the Company and a partner could generate up to several hundred million in sales in the first full three years. Still, for valuation purposes, considering the number of future years a forecast would entail, our first full-year top-line sales estimate for 2029 is $75 million.

RISK FACTORS

In our view, the Company’s biggest risk is related to the prospective clinical trial success of OKYO’s lead candidate, OK-101. If results of the ongoing Phase II NCP clinical trial are comparable to the Company’s other data, it is likely to be deemed a success, leading to negotiations with FDA for the development of the Phase 3 trial program. However, it is always possible that data related directly to primary and secondary endpoints provide upside and downside surprises. The next major risk is related to the ability of the Company to successfully attract a joint venture partner that could help fund a Phase 3 trial via research development investments and potentially pay royalties to market an approved product in the US. In our view, given that existing therapies for DED are widely considered to be subpar, favorable top-line NCP data could attract a number of prospective partners that have historically demonstrated a model that features external investment and M&A as a primary R&D path.

Other risks could come from competing firms with drugs under development that may be migrated to an NCP trial and subsequently demonstrate greater efficacy in their clinical trials. Clearly, these competitors are not yet in the clinic, which puts OKYO presently in the lead. Nevertheless, these other potential competitors could attract partners, making the execution of favorable joint ventures potentially challenging for the Company.

The aforementioned risks could come from larger competitors, existing firms, or new entrants. Still, these future concerns are consistent with firms of OKYO’s size and standing. Moreover, we believe that OKYO’s seasoned management team is prepared to overcome these hurdles and execute its R&D and business development objectives.

Volatility and liquidity are typical concerns for small cap and microcap stocks. An overriding financial benefit as a public company is the favorable access to and the availability of capital to fund research and development, product launches, marketing campaigns and other initiatives. Since the proceeds of any future funding for OKYO would be used in large part to advance its lead drug candidate, we believe that any dilutive effect from such a funding could be offset by related, future increases in market value.

VALUATION

Given that the Company is primed to reach a key valuation-changing milestone with the release of Phase 2 data for NCP at year-end, we have elected to publish a price target that we expect could be achieved in the next 12 months. If multi-dose data and efficacy match OKYO’s primary and secondary objectives, we believe that these data could serve as a catalyst for a mid-tier – to top tier pharmaceutical firm to seek to enter into a transaction with OKYO. This transaction could be in the form of M&A or an investment and related licensing or partnership arrangement with OKYO in exchange for future R&D. We believe that given the safety profile, a compassionate care usage profile could be granted by the FDA, thereby enabling OKYO and a potential partner to benefit. Moreover, due to the nature of OK-101’s chemistry, administration, and its first-mover advantage, we strongly believe that the Company’s OK-101 (and a partner or an acquirer) could be well positioned to be the first FDA approved topical solution for the treatment of NCP.

Against this backdrop, in 1H26, we envision a potential investment for future R&D, with additional funds to be invested based on R&D and other milestones, and a potential right to acquire a majority stake in or an outright purchase of OKYO.

Our 12-month, pre-data release price target is $5.00 and is designed to reflect the potential valuation assessed following a successful Phase 2 trial for a first mover product slated to treat an unmet medical need that represents a large market opportunity. We believe that in 2026/2027, when a deal with a partner could occur, the Company would benefit from a re-valuation of these shares. This price target is affirmed by a future valuation estimate. This estimate assumes $75M in annual CY2029 sales for an FDA-approved OK-101 and an assigned 6.5x sales multiple, which represents a slight discount to the median multiple assigned to a series of ocular M&A transactions. We thus arrive at a future potential $487M valuation in an acquisition. Our 12-month price target of $5.00 reflects this figure discounted back four years at a rate of 30%, on a Net Present Value basis/

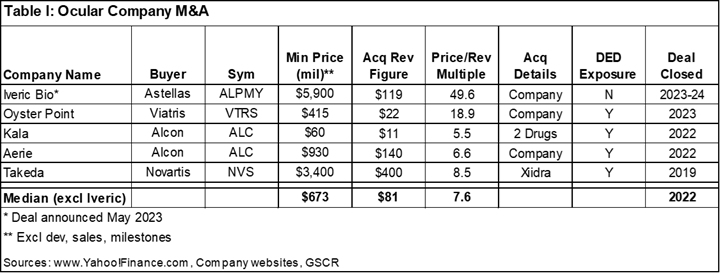

As noted above, there has been a flurry of ocular company M&A by Big Pharma that have carried outsized valuations. As outlined in Table I, the deals we described were sold for a median of 7.6x trailing twelve-month revenue.

CONCLUSION

OKYO Pharma is focused on developing OK-101 to treat NCP which presently has no FDA approved drug to treat this debilitating ocular disease. OKYO Pharma commenced its Phase 2 trial of OK-101 in October 2024 and results are expected by year-end 2025. OKYO is the first company to be granted an investigational new drug (IND) application for NCP by FDA for clinical trials in NCP patients, and the first company to launch a clinical trial in NCP patients specifically diagnosed with NCP. This trial is on the heels of a favorable DED Phase 2 trial of OK-101 which notably demonstrated statistical significance in an ocular pain secondary endpoint.

The potential size of the NCP market assuming NCP receives Orphan Drug designation is $6.4 billion. The market opportunity for the first drug to receive FDA approval to treat this major unmet medical need is based on a 160,000 US potential patient size.

We believe that given its positioning, and assuming data are favorable, OKYO will likely also attract a potential joint venture development partner or an acquirer by 2026/2027. We believe the results from this trial represent a major binary event, serving as a major catalyst for a re-valuation of the stock. Our 12-month, pre-data release price target for OKYO is $5.00. This target is based on the prospective value of OK-101, projected sales multiples discounted back four years, and the median valuation of ocular biopharma M&A deals.

RECENT TRADING HISTORY FOR OKYO

(Source: www.StockCharts.com)

Senior Analyst: Robert Goldman

Rob Goldman founded Goldman Small Cap Research in 2009 and has over 25 years of investment and company research experience as a senior research analyst and as a portfolio and mutual fund manager. During his tenure as a sell side analyst, Rob was a senior member of Piper Jaffray’s Technology and Communications teams. Prior to joining Piper, Rob led Josephthal & Co.’s Washington-based Emerging Growth Research Group. In addition to his sell-side experience Rob served as Chief Investment Officer of a boutique investment management firm and Blue and White Investment Management, where he managed Small Cap Growth portfolios and The Blue and White Fund.

Analyst Certification

I, Robert Goldman, hereby certify that the view expressed in this research report accurately reflect my personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the recommendations or views expressed in this research report.

Disclaimer

This Opportunity Research report was prepared for informational purposes only.

Goldman Small Cap Research, (a division of Two Triangle Consulting Group, LLC) produces research via two formats: Goldman Select Research and Goldman Opportunity Research. The Select format reflects the Firm’s internally generated stock ideas along with economic and stock market outlooks. Opportunity Research reports, updates and Microcap Hot Topics articles reflect sponsored (paid) research but can also include non-sponsored micro-cap research ideas that typically carry greater risks than those stocks covered in the Select Research category. It is important to note that while we may track performance separately, we utilize many of the same coverage criteria in determining coverage of all stocks in both research formats. Research reports on profiled stocks in the Opportunity Research format typically have a higher risk profile and may offer greater upside. Goldman Small Cap Research was compensated by the Company in the amount of $4000 for a research report production and distribution, including a press release. In 2023, Goldman Small Cap Research was compensated by a third party (TraDigital Marketing Group, Inc.) in the amount of $4000 for a research report production and distribution, including a press release. All information contained in this report was provided by the Company via filings, press releases or its website, or through our own due diligence. Our analysts are responsible only to the public, and are paid in advance to eliminate pecuniary interests, retain editorial control, and ensure independence. Analysts are compensated on a per report basis and not on the basis of his/her recommendations.

Goldman Small Cap Research is not affiliated in any way with Goldman Sachs & Co.

Separate from the factual content of our articles about the Company, we may from time to time include our own opinions about the Company, its business, markets and opportunities. Any opinions we may offer about the Company are solely our own and are made in reliance upon our rights under the First Amendment to the U.S. Constitution, and are provided solely for the general opinionated discussion of our readers. Our opinions should not be considered to be complete, precise, accurate, or current investment advice. Such information and the opinions expressed are subject to change without notice.

The information used and statements of fact made have been obtained from sources considered reliable but we neither guarantee nor represent the completeness or accuracy. Goldman Small Cap Research did not make an independent investigation or inquiry as to the accuracy of any information provided by the Company, or other firms. Goldman Small Cap Research relied solely upon information provided by the Company through its filings, press releases, presentations, and through its own internal due diligence for accuracy and completeness. Such information and the opinions expressed are subject to change without notice. A Goldman Small Cap Research report or note is not intended as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed. This report does not take into account the investment objectives, financial situation, or particular needs of any particular person. This report does not provide all information material to an investor’s decision about whether or not to make any investment. Any discussion of risks in this presentation is not a disclosure of all risks or a complete discussion of the risks mentioned. Neither Goldman Small Cap Research, nor its parent, is registered as a securities broker-dealer or an investment adviser with FINRA, the U.S. Securities and Exchange Commission or with any state securities regulatory authority.

ALL INFORMATION IN THIS REPORT IS PROVIDED “AS IS” WITHOUT WARRANTIES, EXPRESSED OR IMPLIED, OR REPRESENTATIONS OF ANY KIND. TO THE FULLEST EXTENT PERMISSIBLE UNDER APPLICABLE LAW, TWO TRIANGLE CONSULTING GROUP, LLC WILL NOT BE LIABLE FOR THE QUALITY, ACCURACY, COMPLETENESS, RELIABILITY OR TIMELINESS OF THIS INFORMATION, OR FOR ANY DIRECT, INDIRECT, CONSEQUENTIAL, INCIDENTAL, SPECIAL OR PUNITIVE DAMAGES THAT MAY ARISE OUT OF THE USE OF THIS INFORMATION BY YOU OR ANYONE ELSE (INCLUDING, BUT NOT LIMITED TO, LOST PROFITS, LOSS OF OPPORTUNITIES, TRADING LOSSES, AND DAMAGES THAT MAY RESULT FROM ANY INACCURACY OR INCOMPLETENESS OF THIS INFORMATION). TO THE FULLEST EXTENT PERMITTED BY LAW, TWO TRIANGLE CONSULTING GROUP, LLC WILL NOT BE LIABLE TO YOU OR ANYONE ELSE UNDER ANY TORT, CONTRACT, NEGLIGENCE, STRICT LIABILITY, PRODUCTS LIABILITY, OR OTHER THEORY WITH RESPECT TO THIS PRESENTATION OF INFORMATION.

For more information, visit our Disclaimer: www.goldmanresearch.com