RGBP: Phase I Clinical Trial Candidate to Drive Valuation Higher

July 17, 2025

REGEN BIOPHARMA, INC.

Industry: BioPharma

Price Target: $0.30

![]() Download Report in PDF Or Scroll down to read the complete report below.

Download Report in PDF Or Scroll down to read the complete report below.

REGEN BIOPHARMA, INC.

Phase I Clinical Trial Launch to Drive RGBP to New Year Highs

Rob Goldman

July 17, 2025

REGEN BIOPHARMA, INC. (OTC: RGBP: $0.04989)

Industry: BioPharma

Price Target: $0.30

COMPANY SNAPSHOT

Regen BioPharma, Inc. is focused on developing innovative treatments using autologous cell therapies, RNA and DNA-based immunotherapy and small molecules in the immune-oncology segment. The Company seeks to rapidly advance novel technologies through pre-clinical and Phase I/ II clinical trials. Currently, Regen has one cleared Investigational New Drug Application and 2 others pending FDA approval.

KEY STATISTICS

- Price as of 7/16/25

$0.04989 - 52 Wk High – Low

$0.295 – $0.042 - Est. Shares Outstanding

31.6M - Market Capitalization

$1.6M - Average Volume

29,807 - Exchange:

OTCID

COMPANY INFORMATION

Regen BioPharma, Inc.

4700 Spring Street

Suite 304

La Mesa CA 91942

Web: www.RegenBiopharmaInc.com

Email: david.koos@regenbiopharma.com

Phone : 619.722.5505

INVESTMENT HIGHLIGHTS

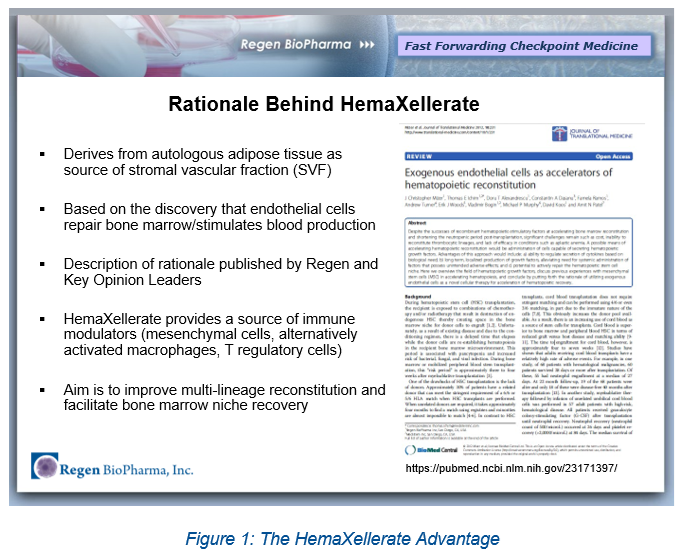

Regen is on the cusp of making a major leap from the preclinical biopharma stage to a clinical stage biopharma. The Company’s lead candidate, HemaXellerate, is an innovative stem cell-derived therapy and the Company plans to launch a Phase I clinical trial in the coming months.

HemaXellerate’s primary indication is to treat chemotherapy patients who have developed a potentially terminal side effect, severe aplastic anemia. The only approved therapy is a costly stem cell transplant, which needs a matched donor and can lead to graft-versus-host disease. Still, the Regen therapy represents $1 billion in market size.

Regen could be awarded an Orphan Drug Designation (ODD) for this product, which would be a major coup for the Company. Regen is also evaluating expanded applications for this groundbreaking therapy.

With two other filed INDs and a deep pipeline Regen is no one-trick pony. The Company has been awarded 11 patents with 17 patents pending.

We believe that these shares are grossly undervalued based on the IP alone. When taking into account Regen’s migration to the clinical stage, this status becomes even more pronounced, given the typical market cap assigned to its peers.

Our price target of $0.30 reflects a meaningful discount to the typical market caps enjoyed by active Phase I clinical trial peers. However, if the drug is awarded Orphan Drug Designation, our target could prove to be conservative.

COMPANY OVERVIEW

The View from 30,000 Feet

Our initiation of coverage report on Regen BioPharma, Inc. (OTCID: RGBP, RGPP) was originally published in October 2023. While the Company’s positioning offered great potential in 2023, in our view, Regen’s current standing is overwhelmingly compelling. In fact, we do not believe we have come across a greater risk/reward profile than Regen in more than 15 years. Regen’s market cap does not even come close to reflecting the proper value for these shares, at current prices. Therefore, we believe substantial upside exists in Regen’s shares. As Regen evolves from an underfollowed preclinical stage firm to a clinical phase firm with multiple, additional IND submissions with the FDA, we expect to see a further revaluation beyond our current $0.30 price target.

The Pipeline

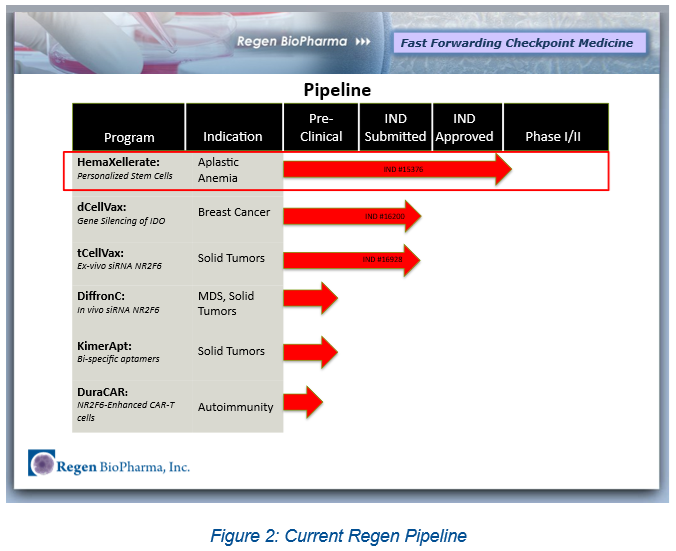

Leveraging an impressive array of IP, the Company plans to rapidly advance novel technologies through pre-clinical and Phase I/ II clinical trials.

Regen has an FDA-cleared IND (Investigational New Drug) application for HemaXellerate™, the Company’s innovative stem cell-derived therapy. The Company plans to launch a Phase I clinical trial in the coming months. The primary indication is to treat chemotherapy patients who have developed a potentially terminal side effect, severe aplastic anemia. There is no direct, approved therapy for this condition while undergoing chemotherapy and Regen could be awarded an Orphan Drug Designation (ODD) and possibly a Fast Track Designation for this product, which would be major coups for Regen. The Company is evaluating expanded applications for this groundbreaking therapy in a market poised for significant growth.

Regen boasts a dynamic and deep pipeline. In addition to HemaXellerate™, Regen has two IND submissions at the FDA. These include dCellVax, an indication for breast cancer and tCellVax, an indication for solid tumors. Moreover, the Company has 3 additional preclinical therapies targeting solid and liquid tumors.

At present, Regen has 11 patent awards with 17 pending. Importantly, much of the Company’s pipeline focuses on small molecules that activate and inhibit a novel gene (NR2F6) which controls how the immune system reacts to cancer cells and to inflammatory responses. Thus, Regen’s development pathways target innovative treatments using autologous cell therapies (HemaXellerate™), and gene silencing utilizing RNA and DNA-based immunotherapy and small molecules in the immune-oncology space.

Looking Ahead

Investors should focus their attention on the Phase I clinical trial candidate and related, upcoming milestones. These include the launch of the trial, patient enrollment, followed by the closing of the trial, data review, and the future release of top-line data. With the commencement or conclusion of each milestone, Regen’s shares should enjoy a bump in valuation, which is typical for early-stage biopharma companies. Plus, we believe that the Company could move preclinical products in its pipeline toward the same development pathway as HemaXellerate.™.

We believe that the Phase I trial could commence in early 1Q26, thus, we project our price target could be met at that time.

Valuation

As we alluded above, in our view, these shares are underfollowed and thus, undervalued. It is a rare find that a Company with an FDA-cleared IND and a robust pipeline and deep IP should trade at such a low level. It has been our experience that a biopharma firm with an active Phase I clinical trial candidate can trade at a valuation of $15-20M. If the candidate is awarded Orphan Drug Designation, which we believe could be in the cards here, the average market cap could emerge at a premium to this range. Therefore, when the Street discovers Regen, which may not occur until trial enrollment commences, we foresee a future revaluation that is normalized to industry standards. In the meantime, our near term $0.30 price target reflects a roughly $10M market cap, which is still a meaningful discount to the $15-20M typical range for active Phase I clinical trial candidate firms, and could prove to be conservative, in hindsight.

REGEN’S LEAD CANDIDATE

HemaXellerate™ is a personalized cellular therapeutic product designed to stimulate blood production in patients whose bone marrow is not properly functioning. Bone marrow damage can occur from radiation, chemotherapy, or chronic conditions. HemaXellerate is an innovative stem-cell derived product that offers substantial potential in treating chemotherapy-induced bone marrow suppression, a market management values at $1 billion annually. This is evidenced by the success of products like Neulasta, which address similar unmet needs.

The HemaXellerate process is straightforward. Belly fat is removed by liposuction and the trial will feature only one treatment, with outcomes measured six months following the treatment. As outlined below, neutrophil and hemoglobin levels are measured as response criteria, which mirrors certain other treatments. There will likely be 12-15 patients enrolled in two California-based sites and a CRO (Clinical Research Organization) has been selected to run the trial. The primary endpoint, as with most Phase I trials, is to determine safety and, on a secondary basis, the degree of efficacy. We believe the process could commence around year-end, with enrollment to begin in 1Q26. We anticipate that results could be released in under 18 months following enrollment. If all goes well, a Phase 2B trial with many more patients would be initiated.

However, we believe that based on potential future data and the current circumstances regarding the seriousness of the condition and current treatments, a partner firm could approach Regen and co-develop the drug, going forward. This would be a major bonus for Regen and certainly a boost for shareholders. A Phase IIb trial would likely be initiated and funded by the partner.

As noted above, one of the challenging side effects of chemotherapy is severe aplastic anemia, the primary indication in which the Company is targeting.

Severe Aplastic Anemia Primer

Severe Aplastic Anemia (SAA) is a life-threatening bone marrow failure disorder that can occur, on rare occasions, with patients undergoing chemotherapy treatments. If afflicted with SAA, patients’ bone marrow stops producing enough red cells, white cells, and platelets. This stage of anemia is considered severe based on certain results indicating dangerous platelet and neutrophils counts, along with the associated reduction in bone marrow cellularity. Symptoms of SAA include fatigue, infections, and bleeding due to pancytopenia.

While causes include an autoimmune attack on bone marrow stem cells, the toxicity of chemotherapy can prompt the condition as well. Still, in more than half of all cases, the direct cause is idiopathic, or unknown. SAA is diagnosed via bone marrow biopsy or a complete blood count that breaks down white blood cells.

With respect to treatment options, bone marrow stem-cell transplants are very expensive and there are challenges finding a donor. With FDA clearance to begin clinical trials, HemaXellerate™ has the potential to redefine the treatment landscape—not just for aplastic anemia but for a wide range of hematological disorders.

Current FDA approved therapies have issues. For example, there are immunosuppressive therapies, but they tend to be secondary indications for SAA. An ATG, or anti-thymocyte globulin therapy, is an immunotherapy designed to control T-cell immune responses and suppress the immune attack on bone marrow. These are used mainly in transplants and aren’t always well tolerated and can be combined with cyclosporine which may have its own poor side effect profile of their own, especially for chemotherapy patients. Other treatments may seek to alter a platelet count.

The bottom line is that the available treatments are secondary in nature and there is no FDA approved therapy for SAA in chemotherapy patients. Since it is a rare condition, it is likely that Regen receives Orphan Drug Designation which is considered by the FDA when a condition affects fewer than 200,000 patients. A cursory review of the total sales of these secondary treatments and hospitalizations for all SAA patients (in the thousands) affirms management’s market size projection of nearly $1 billion in annual sales. While the chemo-specific indication represents fewer patients, an ODD could also lead to a Fast Track designation, thereby speeding time to market. In any event, an ODD designation ultimately translates into much higher price tags for approved drugs. Therefore, it is possible that even for the chemo segment, the Company’s lead candidate could be worth hundreds of millions in annual sales.

THE BUSINESS

Regen BioPharma focuses on creating immune checkpoint medicines. An immune checkpoint is a mechanism by which certain cells of the immune system, typically T cells, are kept from being fully activated. (CAR-T cells are lymphoid cells that are genetically engineered in a laboratory. They have a new receptor so they can bind to cancer cells and kill them. Different types of cancers have different antigens. Each kind of CAR-T cell therapy is made to fight a specific kind of cancer antigen.)

This type of restraint on the immune system is important in the normal functioning of the immune system. However, it is now well-established that many cancers have an ability to trick immune cells into up regulating their checkpoints and thus shut down the ability of these immune cells to kill the tumor. Several drugs which target checkpoints, termed checkpoint inhibitors, are currently used as standard of care in certain cancers. Regen has been focusing its research on a novel immune checkpoint called NR2F6.

RGBP boasts platform technologies that have led to the development of cellular therapies (including CAR-T cells) as well as RNA and DNA technologies for the treatment of various cancers, and personalized stem cells for which the Company received IND clearance. It has submitted two other INDs for cancer therapies whose status are presently dormant but may be re-visited. Clearly, Regen has a valuable, diverse pre-clinical pipeline spanning cell therapies, RNA and DNA therapeutics and small molecule drugs

NR2F6

NR2F6 can be defined as an intracellular immune checkpoint that suppresses adaptive anti-cancer immune responses. It may have properties that when targeted for next-generation immunological regimens, may delay cancer progression and help improve survival. Hence, the patents RGBP owns regarding NR2F6 and cancer therapies. For example, RGBP was granted patents on shRNA that is designed to inhibit NR2F6 expression in CAR-T Cells and make these CAR-T cells have long-term, durable effectiveness. Separately, blocking NR2F6 in CAR-T cells should also make these cells more effective at killing solid tumors.

dCellVax

CellVax is a dendritic cell-based immunotherapy that stimulates the patient’s immune system through a process called “gene silencing”. The Company has an IND filed with the FDA for this therapy, with features of a proposed Phase I trial as follows:

- 10 advanced breast cancer patients

- Efficacy endpoints at 6 and 12 months

- Establishment of safety will allow for rapid expansion of patient numbers.

- Currently addressing FDA questions with Dr. Santosh Kesari, head of UCSD Neuro-Oncology program

tCellVax

tCellVax is a cell-based immunotherapy that stimulates the patient’s immune system through gene silencing of NR2F6 (Solid Tumors). This is the third IND on file with the FDA. Testing has included:

- Ex vivo siRNA silencing of NR2F6 in PBMC

- Silencing using tCellVax induces T cell activation (release of checkpoint inhibition)

- Initial indications: solid tumors

- Currently addressing FDA questions with Dr. Santosh Kesari

DiffronC

DiffronC is a novel form of therapy called differentiation therapy that is expected to have much milder toxicity than chemotherapy. The mechanism of action is to correct the specific genes that prevent the myelodysplastic syndrome stem cell from producing mature blood cells. By silencing genes, including the Company’s discovered cancer stem cell target gene, differentiation of cancer cells can be induced. The initial indication is treatment of myelodysplastic syndrome while other indications include solid tumors and acute leukemia.

FINANCIALS SNAPSHOT

There are key line items we scrutinize when reviewing pre-revenue companies and following a review of the Company’s financial statements, we believe that from a financial perspective, the Company has operated in textbook fashion—which is a major positive. The balance sheet has no long-term debt. Moreover, the largest expense is a modest $1.2M in accrued expenses—which is a small amount considering the nature of the business model. This figure is affirmed by the low quarterly burn rate of around $150,000, as outlined in the income statement as it prepares for major, future revenue closings.

Separately, we should note that Acadia is in the process of selling thousands of acres of land acquired for potential microgrid use that is no longer a viable option. Such financial transactions will be noted in future filings.

Looking ahead, we preliminarily forecast CY25 pre-development revenue of $3.8M, which reflect services performed in three NY counties. Our current expectation is that the Company could begin to operate profitably on a quarterly operating basis sometime in 2026, depending upon the timing and year-to-date scale of the project(s) implementation.

For 2026, our estimates suggest that revenue could reach $12M, reflecting more counties in the core NY project come online and other project pre-development deployments increase in size and scope. A bonus contribution could occur from a potential waste-to-energy opportunity as well. Thus, our preliminary expectation is that the Company could begin to operate profitably on a 5-10% quarterly operating basis sometime in 2026, depending upon the timing and year-to-date scale of the project(s) implementation. We would not be surprised to see revenue reach tens of millions in 2027, depending upon funding timing and scale.

While we have elected to currently provide high level revenue and operating profit to reflect variability in funding and implementation timing by its prospective customers and partners, we plan to compile a detailed, projected P&L as visibility normalizes later this year.

THE REGEN LEADERSHIP TEAM

David Koos, PhD, DBA, Chairman, Chief Executive Officer

David Koos has over 30 years of investment banking and venture capital experience. He has a deep knowledge of start-up businesses, public markers and SEC reporting companies. Dr. Koos has extensive relationships with large and small financial institutions, hedge funds and entities that Regen BioPharma expects to leverage for company growth.

Dr. Koos has a Ph.D. in Sociology and a Doctor of Business Administration degree with an emphasis on finance. Additionally, he has authored / co-authored numerous peer reviewed journal articles.

Harry Lander, Ph.D., Chief Scientific Consultant

Dr. Lander has over 30 years of professional scientific, business and financial management experience related to biomedical research. As a trained biochemist and immunologist, Dr. Lander bridges the gap between science and business. He has had extensive experience in establishing the Sidra Medical and Research Center in Qatar as well as establishing Weill Cornell Medical College – Qatar and has deep experience with growing biotechnology/pharmaceutical companies. Dr. Lander is currently a Managing Partner of Dyo Biotechnologies, LTD where he oversees strategic consulting for biotechnology projects in Southeast Asia. Dr. Lander was President and Chief Scientific Officer of Regen BioPharma, Inc. Formerly he has served as Research Chief / Administration for Sidra Medical and Research Center (Doha, Qatar) and Assistant Provost for Weill Cornell Medical College (Cornell University). He has extensive managerial and financial experience running complex organizations and establishing new ones. He founded, managed and sold The Gramercy Group, LLC, a NASDAQ market making firm in 2003 (currently Chardan Capital Management) and had multiple SEC licenses.

Scientific Advisory Board Members

Ravinder Reddy, Ph.D.: Dr. Reddy is currently a Professor of Radiology and the Director of the Center for Advanced Metabolic Imaging in Precision Medicine at the University of Pennsylvania. His research interests are in studying molecular and structural changes in various diseases including cancer. He has published important papers on the mechanisms of CAR T-cell toxicities as well as ways to monitor immunotherapy effectiveness. Dr. Reddy is the recipient of several prestigious biomedical research awards including grants from the Whitaker Foundation, DANA Foundation and National Institutes of Health. He is also a member of many prestigious professional organizations and societies and serves on the editorial boards of several journals in the field. With more than 200 peer-reviewed papers and 15 patents, Dr. Reddy has been inducted as a Fellow of the International Society of Magnetic Resonance in Medicine and has been named to the Council of Distinguished Investigators of the Academy of Radiology Research.

Mohammad Haris, Ph.D.: Dr. Haris is an Associate Professor in the Center for Advanced Metabolic Imaging in Precision Medicine, Department of Radiology, Perelman School of Medicine, at the University of Pennsylvania. His research focuses on development of novel quantitative and molecularly specific metabolic imaging technologies to improve outcomes for patients with cancer and neurological/ neurodegenerative disorders. With more than 100 peer reviewed publications and multiple patents, Dr. Haris has extensive expertise in examining and understanding the mechanisms of cancer growth and the tumor microvasculature with publications in high profile journals such as Nature Medicine, Cell, and Nature Biomed Eng. and Molecular Cancer. Dr. Haris received his Ph.D. in Biomedical Imaging and Master’s in Biochemistry from India and did his postdoctoral training at the University of Pennsylvania.

Stefano Bertuzzi, Ph. D, MPH: Dr. Bertuzzi, is currently the Executive Director of the American Society for Cell Biology and has been named Executive Director and CEO of the American Society for Microbiology, effective January 4, 2016. Before leading the American Society for Cell Biology, Dr. Bertuzzi was a senior scientific executive at the National Institutes of Health where he served as Director of the Office of Science Policy, Planning, and Communications, and as a science policy advisor to the NIH Director. Dr. Bertuzzi received his Ph.D. in Molecular Biotechnology from Milan, Italy and his master’s in public health from the Bloomberg School of Public Health at the Johns Hopkins University in Baltimore with a specialization in health policy.

Jonathan Baell, PhD: Dr. Baell is a professor or Medicinal Chemist at Monash University (Australia) whose research is focused on the discovery of new medicines for treating diseases with an unmet medical need. A proven record of undertaking original research with a total of 120 publications and patents. He is published in top-ranked journals in the field (e.g. 12 in Journal of Medicinal Chemistry, Nature Chemical Biology, Nature). He has 40 granted patents listed at www.lens.org.

He has won a national award for discovery of a new class of potential multiple sclerosis therapeutics. Additionally, he has achieved successful outcomes in a diverse array of drug discovery arenas, from rational design of peptidomimetics to heterocyclic drug discovery.

For the period 2012-16, Dr. Baell is Chief Investigator on competitive grants that totaled $4.73M. In addition, he has been awarded a prestigious NHMRC Senior Research Fellowship for the period 2012-2016. In 2011 and elected as the Australian representative to the Board of Directors for the Inaugural International Chemical Biology Society and appointed Chair of Membership.

Rohit Duggal, Ph.D.: An experienced industry executive with specialization in establishing and advancing biotherapeutic products targeting cancer. Dr. Duggal has more than 23 years of industry experience that spans cellular immunotherapy, immuno-oncology, oncolytic virotherapy, translational oncology and antiviral drug discovery. Currently VP of Research at TRL, he was the head of R&D and site head of ONK Therapeutics Inc. Before that, Rohit led the primary lymphocyte product development program at NantKwest. At Sorrento Therapeutics he helped develop the immuno-oncology franchise that included antibodies in different formats. Rohit obtained his Ph.D. from Texas A&M University.

Hinrich Gronemeyer, Ph.D.: Research Director at the IGBMC in Strasbourg-Illkirch and Research Director (Class ‘Exceptional’) of the French National Institute of Health and Medical Research (INSERM). His nearly 200 publications received an average citation of 83.34. Hinrich Gronemeyer contributed to pioneering work on nuclear receptors and their therapeutic intervention by design of small molecule ligands.

Additional SAB members can be found on the Company website.

FINANCIALS SNAPSHOT

As evidenced by its quarterly financials, Regen runs a lean ship, with very modest operating losses. Importantly, the Company has no long-term debt, which is somewhat unusual in this space. Perhaps that is why we are confident that management can secure a favorable funding arrangement for general corporate purposes and R&D.

Too many companies have a significant percentage of shares outstanding in the public float. Conversely, regen only has about 59% of its outstanding shares in the current public float. In our view, this is a major positive from a fundamental and trading perspective.

CONCLUSION

Regen is on the cusp of making a major leap from the preclinical biopharma stage to a clinical stage biopharma. The Company’s lead candidate, HemaXellerate, is an innovative stem cell-derived therapy and the Company plans to launch a Phase I clinical trial in the coming months. HemaXellerate’s primary indication is to treat chemotherapy patients who have developed a potentially terminal side effect, severe aplastic anemia. The only approved therapy is a costly stem cell transplant, which needs a matched donor and can lead to graft-versus-host disease. Still, the Regen therapy represents $1 billion in market size. Regen could be awarded an Orphan Drug Designation (ODD) for this product, which would be a major coup for the Company. Regen is also evaluating expanded applications for this groundbreaking therapy. With two other filed INDs and a deep pipeline Regen is no one-trick pony. The Company has been awarded 11 patents with 17 patents pending.

We believe that these shares are grossly undervalued based on the IP alone. When taking into account Regen’s migration to the clinical stage, this status becomes even more pronounced, given the typical market cap assigned to its peers. Our price target of $0.30 reflects a meaningful discount to the typical market caps enjoyed by active Phase I clinical trial peers. However, if the drug is awarded Orphan Drug Designation, our target could prove to be conservative.

SENIOR ANALYST: ROBERT GOLDMAN

Rob Goldman founded Goldman Small Cap Research in 2009 and has over 20 years of investment and company research experience as a senior research analyst and as a portfolio and mutual fund manager. During his tenure as a sell side analyst, Rob was a senior member of Piper Jaffray’s Technology and Communications teams. Prior to joining Piper, Rob led Josephthal & Co.’s Washington-based Emerging Growth Research Group. In addition to his sell-side experience Rob served as Chief Investment Officer of a boutique investment management firm and Blue and White Investment Management, where he managed Small Cap Growth portfolios and The Blue and White Fund.

Analyst Certification

I, Robert Goldman, hereby certify that the view expressed in this research report accurately reflect my personal views about the subject securities and issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly, related to the recommendations or views expressed in this research report.

Disclaimer

This Opportunity Research report was prepared for informational purposes only.

Goldman Small Cap Research, (a division of Two Triangle Consulting Group, LLC) produces research via two formats: Goldman Select Research and Goldman Opportunity Research. The Select format reflects the Firm’s internally generated stock ideas along with economic and stock market outlooks. Opportunity Research reports, updates and Microcap Hot Topics articles reflect sponsored (paid) research but can also include non-sponsored micro-cap research ideas that typically carry greater risks than those stocks covered in the Select Research category. It is important to note that while we may track performance separately, we utilize many of the same coverage criteria in determining coverage of all stocks in both research formats. Research reports on profiled stocks in the Opportunity Research format typically have a higher risk profile and may offer greater upside. During 2023, Goldman Small Cap Research was compensated by a third party in the amount of $5000 for research reports and a press release. Goldman Small Cap Research was compensated $5000 for this research report and a press release. All information contained in this report was provided by the Company via filings, press releases or its website, or through our own due diligence. Our analysts are responsible only to the public, and are paid in advance to eliminate pecuniary interests, retain editorial control, and ensure independence. Analysts are compensated on a per report basis and not on the basis of his/her recommendations.

Goldman Small Cap Research is not affiliated in any way with Goldman Sachs & Co.

Separate from the factual content of our articles about the Company, we may from time to time include our own opinions about the Company, its business, markets and opportunities. Any opinions we may offer about the Company are solely our own and are made in reliance upon our rights under the First Amendment to the U.S. Constitution, and are provided solely for the general opinionated discussion of our readers. Our opinions should not be considered to be complete, precise, accurate, or current investment advice. Such information and the opinions expressed are subject to change without notice.

The information used and statements of fact made have been obtained from sources considered reliable but we neither guarantee nor represent the completeness or accuracy. Goldman Small Cap Research did not make an independent investigation or inquiry as to the accuracy of any information provided by the Company, or other firms. Goldman Small Cap Research relied solely upon information provided by the Company through its filings, press releases, presentations, and through its own internal due diligence for accuracy and completeness. Such information and the opinions expressed are subject to change without notice. A Goldman Small Cap Research report or note is not intended as an offering, recommendation, or a solicitation of an offer to buy or sell the securities mentioned or discussed. This report does not take into account the investment objectives, financial situation, or particular needs of any particular person. This report does not provide all information material to an investor’s decision about whether or not to make any investment. Any discussion of risks in this presentation is not a disclosure of all risks or a complete discussion of the risks mentioned. Neither Goldman Small Cap Research, nor its parent, is registered as a securities broker-dealer or an investment adviser with FINRA, the U.S. Securities and Exchange Commission or with any state securities regulatory authority.

ALL INFORMATION IN THIS REPORT IS PROVIDED “AS IS” WITHOUT WARRANTIES, EXPRESSED OR IMPLIED, OR REPRESENTATIONS OF ANY KIND. TO THE FULLEST EXTENT PERMISSIBLE UNDER APPLICABLE LAW, TWO TRIANGLE CONSULTING GROUP, LLC WILL NOT BE LIABLE FOR THE QUALITY, ACCURACY, COMPLETENESS, RELIABILITY OR TIMELINESS OF THIS INFORMATION, OR FOR ANY DIRECT, INDIRECT, CONSEQUENTIAL, INCIDENTAL, SPECIAL OR PUNITIVE DAMAGES THAT MAY ARISE OUT OF THE USE OF THIS INFORMATION BY YOU OR ANYONE ELSE (INCLUDING, BUT NOT LIMITED TO, LOST PROFITS, LOSS OF OPPORTUNITIES, TRADING LOSSES, AND DAMAGES THAT MAY RESULT FROM ANY INACCURACY OR INCOMPLETENESS OF THIS INFORMATION). TO THE FULLEST EXTENT PERMITTED BY LAW, TWO TRIANGLE CONSULTING GROUP, LLC WILL NOT BE LIABLE TO YOU OR ANYONE ELSE UNDER ANY TORT, CONTRACT, NEGLIGENCE, STRICT LIABILITY, PRODUCTS LIABILITY, OR OTHER THEORY WITH RESPECT TO THIS PRESENTATION OF INFORMATION.